Previously at Odds, Why Banks Now See CFPB as an Ally

For years, American financial companies have fought the Consumer Financial Protection Bureau (CFPB) — the chief U.S. consumer finance watchdog — portraying the agency as illegitimate and as unfairly targeting the banking industry. 1

Now, following orders by the Trump administration, the CFPB has been gutted and its headquarters shuttered, and the agency finds itself with an unlikely ally; the same banks that reliably complained about its rules and enforcement actions, are now looking to it for help.

If the administration’s directives succeed in severely reducing or eliminating the CFPB, banks would find themselves competing directly with nonbank financial players. Big tech and fintech firms, as well as mortgage, auto and payday lenders - these digital banks enjoy far less federal scrutiny than banks that are FDIC-backed institutions.

“The CFPB is the only federal agency that supervises non-depository institutions, so that would go away,” said David Silberman, a veteran banking attorney who lectures at Yale Law School. “Payment apps like PayPal, Stripe, and Cash App, … would get close to a free ride at the federal level.” 1

The CFPB was created in the aftermath of the 2008 financial crisis. The shift away from it could revert us back to a time when it was largely left to state officials to regulate the industry and protect consumers.

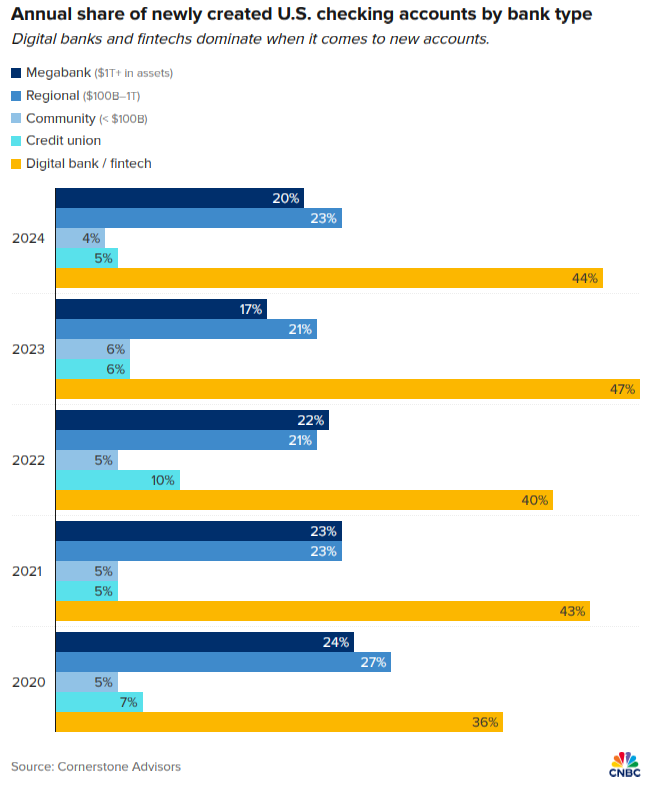

However, since then, the banking landscape has changed significantly, and digital players have encroached significantly by offering banking services via mobile phone apps. Fintechs led by PayPal and Chime had roughly as many new accounts as all large and regional banks combined last year, according to data from Cornerstone Advisors1 (see Chart I).

Chart I

“If you’re the big banks, you certainly don’t want a world in which the nonbanks have much greater degrees of freedom and much less regulatory oversight than the banks do,” Silberman said. 1

In Limbo

The CFPB and its employees are in limbo after Acting Director Russell Vought took over last month, issuing a flurry of directives to the agency’s then 1,700 staff. Working with operatives from the Department of Government Efficiency (DOGE), Vought quickly laid off about 200 workers, reportedly took steps to end the agency’s building lease and canceled contracts required for legally mandated duties. Senior executives at the CFPB shared plans for more layoffs what would significantly hinder the agency’s ability to carry out its supervision and enforcement duties. These actions have triggered a lawsuit brough by a CFPB union asking for a preliminary injunction and now being considered by a federal judge.

All this appears to go beyond what even the Consumer Bankers Association wants. The CBA, which represents the country’s biggest retail banks, recently sued the CFPB over rules limiting overdraft and credit card fees. But as of late, the association noted CFPB’s role in keeping a level playing field among market participants.

“We believe that new leadership understands the need for examinations for large banks to continue, given the intersections with prudential regulatory examinations,” said Lindsey Johnson, president of the CBA, in a statement provided to CNBC. “Importantly, the CFPB is the sole examiner of non-bank financial institutions.”1

Banks Want CFPB to Remain

In the midst of the upheaval, bank executives have gone from antagonists of the CFPB to among those concerned it could disappear.

At a bankers convention in October 2024, JPMorgan Chase CEO Jamie Dimon encouraged his peers to “fight back” against regulators. In response to a proposal by U.S. regulators in July 2023 to align their standards with those of the Basel Committee on Banking Supervision, Dimon noted “the devil’s in the details,” referring to the unfair and unjust regulations hurting companies.

Now, there’s a growing consensus that an initial push to eliminate the CFPB is a mistake. Besides the threat posed from nonbanks, current rules from the CFPB would still exist, with no one around to update them as the industry evolves. Industry advocates also say small banks and credit unions would be even more disadvantaged than their larger peers if the CFPB were to go away.

It appears the consensus from banks is for the CFPB to remain, and for the agency to institute thoughtful policies that will support economic growth and maintain safety and soundness.

1 - Here’s Why Banks Don’t Want the CFPB to Disappear, cnbc.com, 3/10/2025

Visit our website to learn more about IDC’s financial institutions rankings, and view all our products and services.