Minutes from FOMC Signal that Fed Rate Cuts on Hold

Stubborn inflation and uncertainly around economic policy have the Fed putting rate cuts on hold. Minutes from the Federal Open Market Committee (FOMC) meeting at the end of January, released Wednesday, showed that participants indicated they want to see more progress on inflation, given that employment remains near its maximum, before making additional adjustments to the fed funds rate target range.

“Many participants noted that the committee could hold the policy rate at a restrictive level if the economy remained strong and inflation remained elevated,” as was noted from the FOMC’s January minutes.1

Officials at the meeting held the Fed’s benchmark policy rate in a range of 4.25% - 4.5% and underscored the cautious approach being taken by Fed policymakers. After lowering interest rates by a percentage point at the end of 2024, officials said they would like to see inflation cool further, toward a target 2%, before signaling another cut.

There were also concerns around the potential clash over the debt-ceiling. “Regarding the potential for significant swings in reserves over coming months related to debt ceiling dynamics, various participants noted that it may be appropriate to consider pausing or slowing balance sheet runoff until the resolution of this event,” said in the minutes.1

The US government reached its statutory limit for outstanding debt in January. House Republicans have proposed a bill to raise the debt ceiling by $4 trillion, and it will likely take months to negotiate.

Uncertainties in Policy Outcomes

The current administration is pushing an agenda of increased use of tariffs on US trading partners and a crackdown on immigration resulting in millions at risk of deportation. Fed policymakers seem to have a wait-and-see approach to how these policies might shape the economy, specifically, the inflation outlook and labor markets.

“Participants cited the possible effects of potential changes in trade and immigration policy, the potential for geopolitical developments to disrupt supply chains, or stronger-than-expected household spending,” the minutes showed.1

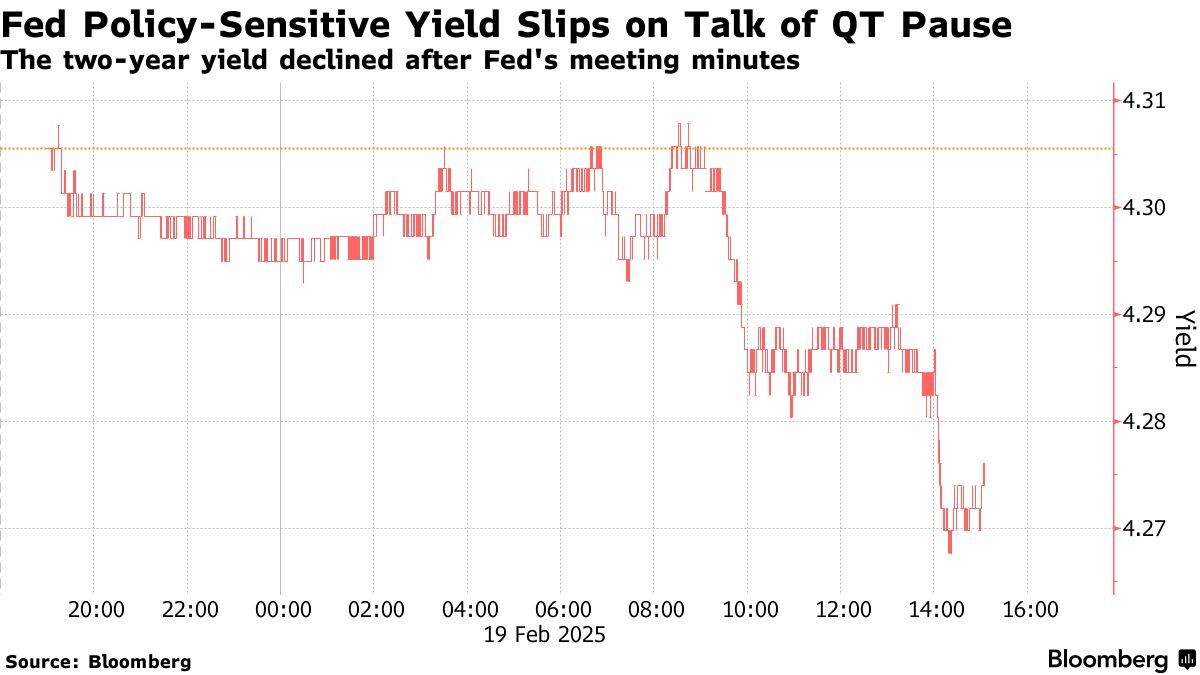

US Treasuries Surge after Fed Meeting2

US Treasuries rose after the minutes from last month’s Federal Reserve meeting revealed policymakers discussed pausing or slowing the balance-sheet runoff until discussion over government’s debt-ceiling is resolved.

The potential need to consider pausing or slowing their balance-sheet runoff, a process known as quantitative tightening, or QT, has been ongoing since June 2022, and remains until lawmakers can strike a deal.

In particular, Fed policymakers cited the potential for significant swings in reserve balances over the coming months and extra cash that banks stash at the Fed might decline quickly once a deal is struck over the debt-ceiling.

Chart I

After the Fed’s meeting minutes release, yields across maturities fell by between one and three basis points, causing the yield curve to steepen. The 10-year yield fell to 4.53%.

The Fed has been winding down its holdings for almost three years, gradually increasing the amount of Treasury and mortgage bonds allowed to run off its balance sheet without being reinvested. So far, the Fed has unwound more than $2 trillion from its balance sheet, leaving about $6.8 trillion in the System Open Market Account — well above the pre-Covid levels around $4 trillion. But some Fed officials are stressing that policymakers need be more cautious about the balance sheet unwind going forward than they have in the past six or eight months.

Most Wall Street strategists have pushed out their expectations for when the Fed will end QT, with several forecasting a stop in the second half of 2025. Fed Chair Jerome Powell said the balance-sheet unwind still has a ways to go.

Could Tariffs Cause Treasury Yield Curve to Flatten?

The U.S. Treasury yield curve could flatten in the wake of President Trump’s tariff announcements. The yield curve flattening means that the spread between 2- and 10-year bond yields narrows. The impact from tariffs on U.S. rates is complex because tariffs can be interpreted as inflationary through higher consumer prices as well as deflationary from a growth perspective.3

As of February 21, 2025, the 10-year Treasury yield was 4.52% and the 2-year Treasury yield was 4.27%. The 10-year yield is higher than the long-term average of 4.25%.

1 - Fed Minutes Signal Officials on Hold Until Inflation Improves, bloomberg.com, 2/19/2025

2 - Treasuries Rise as Fed Minutes Reveal Discussion of Pausing Balance-Sheet Runoff bloomberg.com, 02/19/2025.

3 - Tarriffs Could Cause Treasury Yield Curve to Flatten, wsj.com, 2/3/2025

2024Q4 Ranks for all banks are now available! Visit our website to learn more about IDC’s financial institutions rankings and view all our products and services.