The Fed Should Proceed with Caution Amid Higher Retail Spending and Renewed Inflation

The first half of 2024 showed sluggish spending, but in the second half, consumers were in the mood to spend, with trends accelerating particularly in the last four months of the year. Population growth, more jobs, and greater investment returns were all contributors.

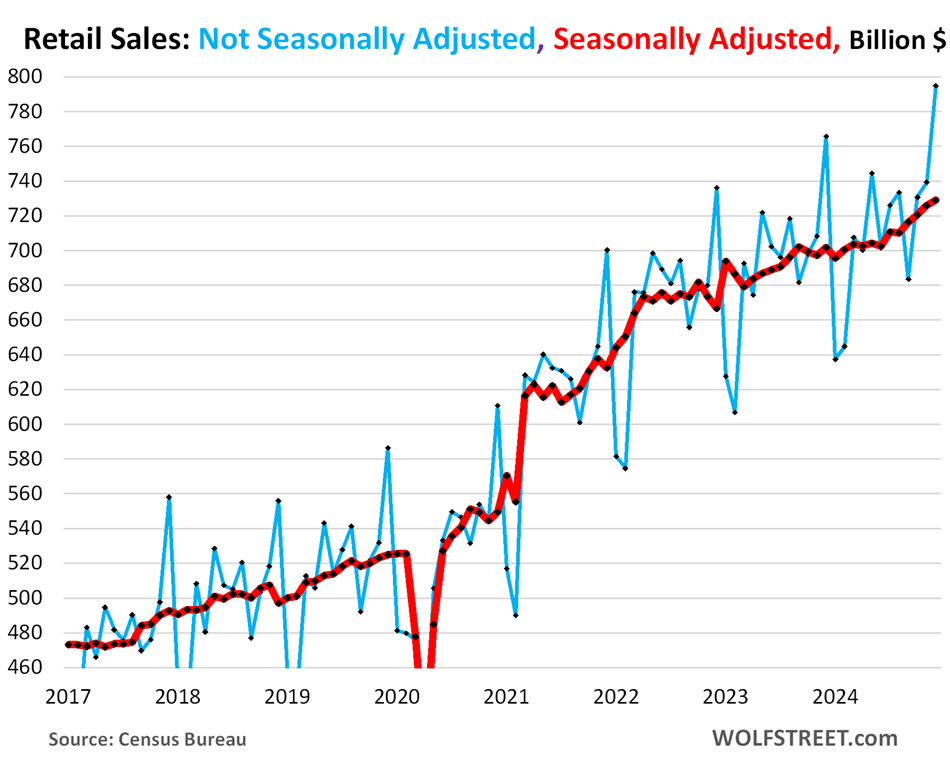

Seasonally adjusted retail sales rose by 0.45% in December from November, or +5.5% annualized, and October and November monthly numbers were both revised higher, to +0.56% and +0.77% respectively.

December retail sales, which were not seasonally adjusted, rose to a record of $794 billion (see Chart I), due to ecommerce sales, the month’s the #1 retailer category.

Chart I

To give additional context, these are retail sales leading up to the surge in spending at the end of the year. The first six months of 2024 lagged significantly compared to the second six months, a period also surpassed by the last four months of 2024.

- 6 months January-June total: +0.1%, annual pace +0.2%

- 6 months July-December total: +3.8%, annual pace +7.7%

- 4 months September-December total: +2.67%, annual pace +8.2%

Effect on GDP

If real GDP growth follows the trend of Atlanta’s GDPNow growth rate, the U.S. is looking at a real GDP at about 3.0%. Over the past 15 years, the U.S. has averaged about 2% GDP growth.

Population, Jobs, and Wages Growth

2024 saw an additional 2.2 million payroll jobs, with hourly earnings up by 4%. Additionally, in recent years, stocks, cryptocurrencies, and real estate prices have soared, and it appears consumers are feeling flush.

Net immigration also added 2.8 million people to the population in the 12 months leading up to July 2024, contributing to a 2.4% increase in the past few years, which is the biggest percentage growth since 2001. Many of these new arrivals are already working, and it seems they are spending money too.

Inflation Picks Up with Demand

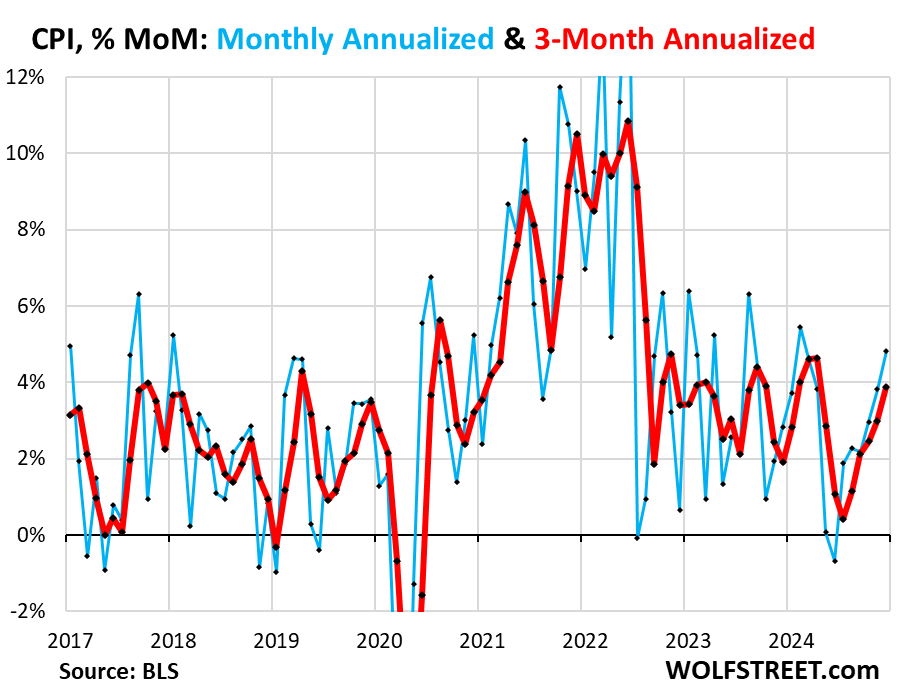

Inflation has been accelerating for the past few months. The Consumer Price Index rose by 0.39% (+4.8% annualized) in December from November, the sharpest increase since February 2024.

The three-month CPI jumped by 3.9% annualized, the sharpest increase since April (see Chart II). The month-to-month rate in CPI has accelerated for five months in a row, and this month-to-month CPI inflation rate over the past four months parallels the surge in retail sales.

In addition, the year-over-year CPI rose by 2.9%, the sharpest increase since July, and the third month in a row of acceleration.

Chart II

Amid all this increased consumer spending, inflation is up, and it remains to be seen how the Fed will manage previously discussed rate cuts.

1 - The Fed Needs to Watch Out: Amid Strong Demand from our Drunken Sailors, Retail Sales Surged in Late 2024..., Wolf Street, 01/16/2025

Visit our website to learn more about IDC’s financial institutions rankings.

To view all our products and services please visit our website www.idcfp.com.