A Strong Labor Market is Driving Supercore Inflation

With the rise in prices, workers are demanding higher pay to preserve their standard of living. Businesses, in turn, are hiking prices to compensate for those bigger wages.

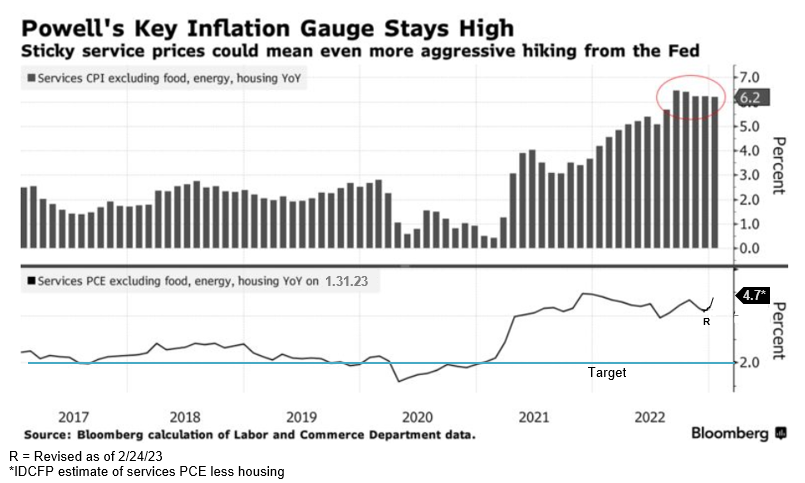

As a result, US central bankers are closely monitoring what’s become known as “supercore inflation,” or the prices in service industries. Wages are a large part of the cost calculation for service industry businesses, such as restaurants and cleaners. As prices continue to ease for goods and commodities, inflation is now focused on workers seeking more pay to keep pace with the cost of living. 1

Chart I

Over the past year, the Fed has raised its benchmark rate by 4.5 percentage points. This increase is the steepest we’ve seen in decades, yet every measure of supercore inflation shows it is still running too hot. Another 75 basis points of Fed rate hikes is expected this year, taking the top of the target range to 5.5%.1

“We think we are going to need to do further rate increases,” Powell said this month. “The labor market is extraordinarily strong.”1

Fed officials like Powell have emphasized the importance of price growth in core services minus housing for an outlook on inflation. This category is believed to be very wage-dependent and includes everything “from health care to haircuts.”1

According to Bloomberg, in January services PCE inflation (excluding housing and energy services) increased 0.6% or 7.2% at an annual rate. This was the second month of acceleration, with revised numbers from December, increasing the year-over-year rate to 4.7% (see Chart I).

At the start of 2023 incomes rose 0.6%, bolstered by the wage growth acceleration. The annual cost-of-living adjustment for Social Security and Supplemental Security Income was the biggest increase in decades. This adjustment offset the expiration of the child tax credit and a decline in one-time payments made by states.

Weather in January was unseasonably warm. The temperate conditions boosted demands for things like dining out. and also drove an increase in the number of hours worked. That likely bolstered the wages and salary metric, as well as overall consumer spending and prices in Friday’s PCE report from the Bureau of Economic Analysis.

Stubborn inflation coupled with resilient spending suggests the Fed’s road to tamed prices and demand will be longer and bumpier than expected, and negates what data in late 2022 indicated. While this extended and rising rate means policymakers will continue to raise borrowing costs higher than expected, it also increases risk of a recession.

1 Jerome Powell’s Worst Fear Could Come True in Southern Job Market, Bloomberg, 02/23/23

To view all our products and services please visit our website www.idcfp.com. For a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director