Super Core, Services Less Rent of Shelter, Runs Hot in January 2023

US consumers prices rose sharply at the start of the year, a sign of persistent inflationary pressures that could cause the Fed to raise interest rates even higher than previously expected.

The overall consumer price index climbed 0.5% in January, the most in three months, supported by rising energy and shelter. Excluding food and energy, the core CPI advanced 0.4% last month and was up 5.6% from a year earlier.

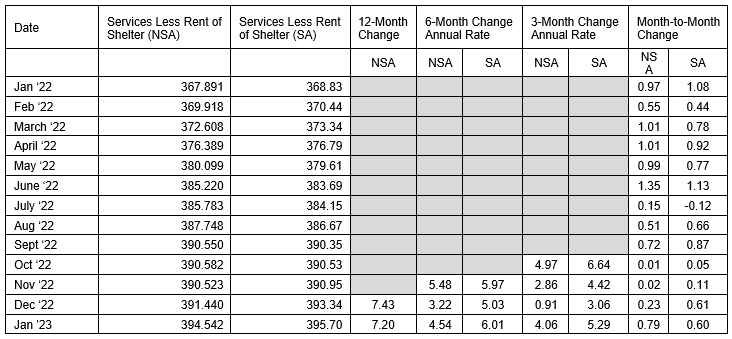

Powell’s preferred rate of inflation is Super Core CPI, which equals services less rent of shelter. Super Core, attempting to capture the underlying wage pressure on prices of non-housing consumer services, rose 0.6% last month, 5.3% over 3 months at an annual rate and 6.0% over 6 months at an annual rate. Super core is running hot.

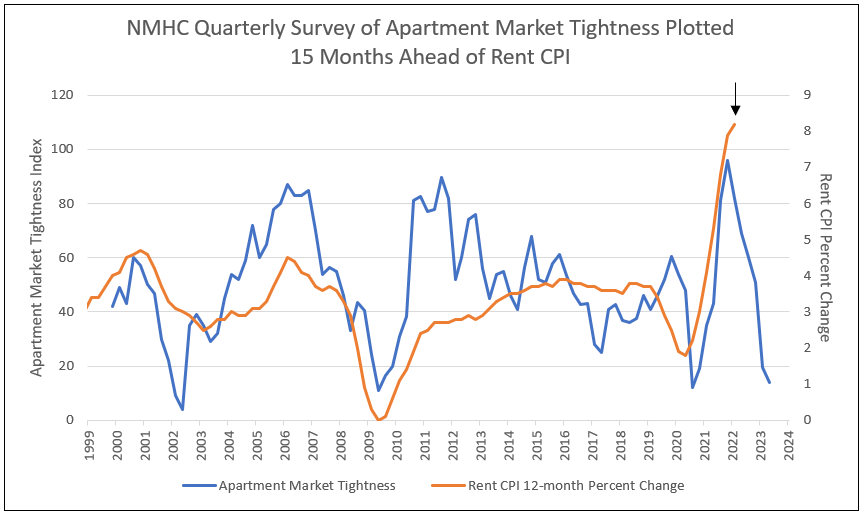

While housing CPI increased to 0.8% from 0.7% a month earlier, future monthly increases should decelerate toward 0.2% (see below).

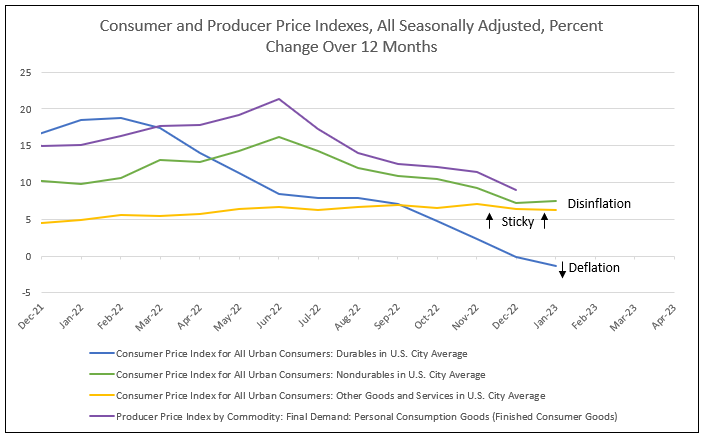

Consumer durables prices continue to be weak, reaching -0.1% in January compared to -0.8% in December. Consumer nondurables, however, excluding food and beverages, rose sharply from -2.3% in December to 1.0% in January (see below).

Table I

Fed Chairman Powell’s Last Core CPI Major Component Still with Inflation, Service Less Rent of Shelter

Strong Employment Report?

The main driver for high inflation in services less housing is wage growth, which equaled 4.4% annual growth in the January employment report.

The strong January jobs report rattled the stock market. Rather than being a sign of a solid labor market, low unemployment might be a sign of “job hoarding,” and lack of strong job demand. This is due to a more limited number of jobs lost in January, but the “seasonal adjustment” turned a less negative into a positive month.1

- January 2023 lost approximately 2.5 million jobs. The most modest decline since 1998.

- The less jobs lost is a function of hoarding due to fear that employees will not be available for rehire later in 2023 or 2024.

Table II

Total Nonfarm Employment Levels

The smaller job loss of -2,505 in January 2023 translated into a 517,000 payroll increase due to seasonal adjustments. Hoarding of jobs, however, is a symptom of the need to pay higher wages in order to retain employees.

Disinflation Coming in Housing

Shelter or housing inflation reached a peak in December 2022 at a 9.6% annual rate and declined to 7.9% in January. Plotted with the National Multifamily Housing Council Index for rent and vacancies, plotted forward 15 months, forecasts a sudden and sharp decline in Rent and OER CPI in the coming months toward 2%. Powell referred to the event as “coming deflation in housing.”

Chart I

Huge Disinflation Coming in Rent CPI

Disinflation and Deflation in Goods Prices

Commodities less food and energy rose only 1.4% for the 12 months ending January 2023. The modest increase was limited due to deflation, or decline, in used cars and trucks prices of 11.6%.

Apparel rebounded in January, up 0.8% versus only 0.2% in December. Medical commodities rose 1.1% in January, while December was up 0.1%. Tobacco products were up 0.7%, compared to a negative 0.1% in December. Conversely, new vehicle prices rose only 0.2%, versus a 0.6% rise in December, and alcoholic beverage prices were up 0.4% versus a 0.7% increase the previous month.

With the used car price index at auction (Manheim index) increasing in 2023, the negative pull of used car prices in the CPI might be at an end.

Chart II

Durable Goods CPI in Deflation Due to Negative Growth in Used Car Prices

Conclusion

- The January CPI report supports the Federal Reserve’s forecast of higher for longer.

- The Fed funds rate increases 25 basis points two more times and becomes data dependent.

- The CPI numbers, when paired with the January blowout job report and signs of enduring consumer resilience, underscore the durability of the economy – and price pressures – despite aggressive Fed policy.

1 Tom Lee, Fundstrat, February 6

To view all our products and services please visit our website www.idcfp.com. For a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director