Forecasting a Recession with the Sahm Rule

Forecasting a recession for a bank is key in determining the loan loss provision (predicting loan loss over the life of the loan) under CELA. As an example, JP Morgan Chase & Co, the biggest bank in the US, is setting aside more than $1 billion in preparation for potential loan losses.

Most economists predict a downturn in the US this year, as a result of the large hike in the Fed funds rate in 2022 aimed at combating inflation. Yet, economists, in the recent past, had noteworthy misses on inflation and GDP. This exercise is more akin to putting together the pieces of a puzzle, with each economic indicator filling in part of the image.

Right now, the pieces are not fitting together well. Manufacturing is in recession, and the housing market has declined significantly, while factory and construction employment remains elevated. Fourth quarter GDP, reported on January 26, was strong, showing that consumer spending (70% of GDP) remained resilient. More important, the January jobs report was strong with 517,000 new jobs reported and an unemployment rate of 3.4%.

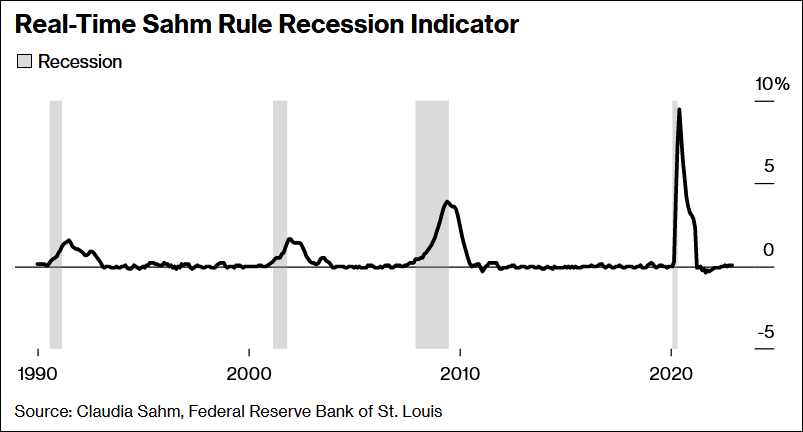

Claudia Sahm, the former Fed economist, came up with her own real-time recession test. Called the Sahm Rule, it requires the three-month average of the unemployment rate to rise by 0.5% or more above the low rate in the previous 12 months. Only then does a downturn begin. Currently, the indicator fails to predict recession. Given the Sahm Rule, and 3.4% unemployment rate in January, an increase of 0.5% to a rate of 3.9% would be required to indicate the beginning of a recession (see Chart I).

Chart I

Source: Bloomberg

Causing further complication is the debt-limit fight between Congress and the Administration which risks an early end to Fed quantitative tightening and slowing the reduction of the Fed’s balance sheet. Through a complex series of reactions, constraints imposed on the Treasury Department by the debt limit could end up reducing quantitative tightening in 2023. Commercial bank reserves held at the Fed form a part of the US financial bedrock.

Dynamics caused by the debt limit could have the effect of a more rapid shrinking of reserves in 2023 – potentially bringing forward the end of quantitative tightening, as the US avoids default.

Quantitative tightening can shrink liquidity via two major channels, bank reserves and so-called reverse repurchase facility, or RPP, which serves as a parking place for money market funds. The difference is which one shrinks, because reserves have a more powerful role in supporting credit in the economy. Looking at the Corporate Bond Market Distress Index from the NY Fed, currently the corporate bond market functioning appears healthy, showing no signs of liquidity problems, but bears monitoring.

Further, the rapid decline in inflation could cause the Fed to stop rate hikes in the first half of 2023 and even reduce rates in late 2023.

The previous two recessions were the product of black swan events: the subprime mortgage crisis and a pandemic. But the coming downturn may be one of the most anticipated in years.

- The 10-year treasury yield minus 3-month yield is the most negative since 1988.

- The decline in temporary help, ISM indicators, regional Fed measurements, and leading indicators of recession from the Conference Board.

- Plus, more unique indicators. Former Fed Chair Alan Greenspan has kept tabs on men’s underwear sales. People buy this basic item year-round, but put off new purchases in a severe economic downturn. Does this mean a significant decline in elective and vanity purchases, like plastic surgery, are also potential leading indicators of recession?

- All the above, however, lack the confirmation of the Sahm Rule Recession Indicator, the key piece to the puzzle.

To view all our products and services please visit our website www.idcfp.com. For a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director