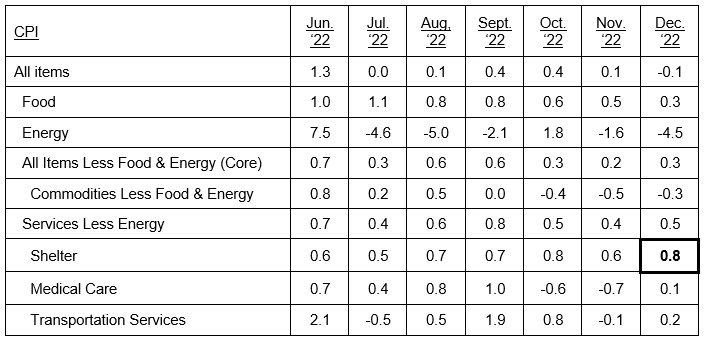

Shelter is the Only Major Component of CPI with Strong Monthly Inflation, Lifting Services Less Energy and Sustaining Core Inflation

Table I

Percent Changes in CPI for All Urban Consumers

Seasonally adjusted changes from preceding month

- December CPI has 59% of components in deflation.

- Wage inflation remains at 3.5%, which is consistent with 2% core CPI (annualized over the last 3 months).

- December core PPI was reported at +0.1 versus +0.4% last month, and a 3-month annualized rate of 2.16%, near the 2% target for core CPI.

- Shelter is the lagging CPI component, reported at 0.8% (sticky) in December, and at 14.1% for the last 3-months annualized, all due to lagging data used by the Federal Reserve.

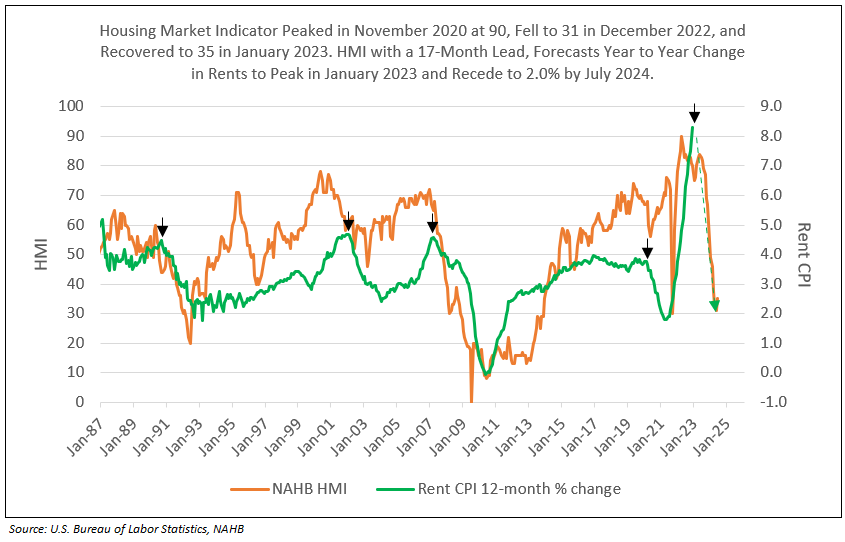

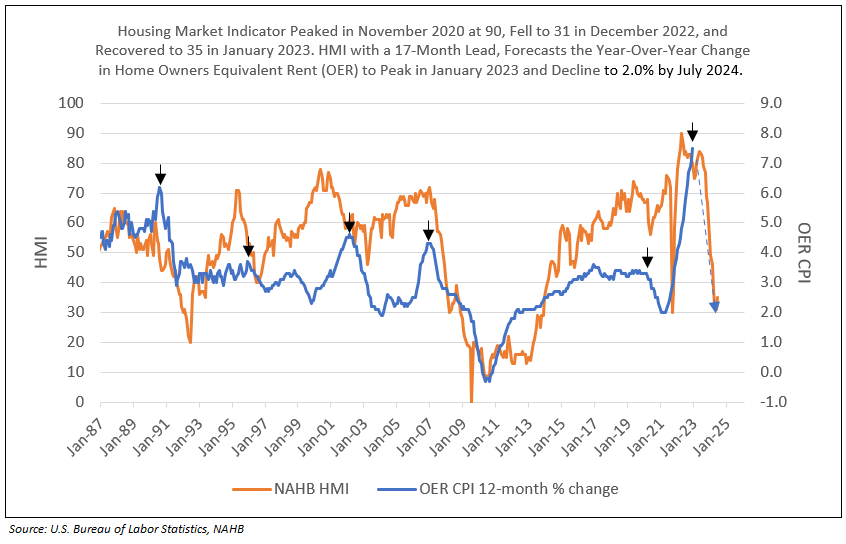

- Shelter, as forecast by the Housing Market Index (HMI), declines to 2% by July 2024, with an average monthly change of -0.3%, or deflation in housing, over the next 17 months (see Charts I and II).

- With the 2-year T-Note yield at 4.12%, the bond market plus the above inflation readings and forecasts all indicate the Fed is almost done raising the Fed funds rate, with another 2.5 basis point hike in February.

A decline in Rent and OER to 2% in July 2024 requires an average month-to-month change of negative 0.3% over the next 17 months.

Chart I

Following the Lead of HMI, Rent Percent Change “Falls Like a Rock” in 2023 and 2024

Chart II

Following a Decline in HMI, OER Percent Change “Falls Like a Rock” in 2023 and 2024

To view all our products and services please visit our website www.idcfp.com. For more information, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

Robin Rickmeier

Marketing Director