Volatility Far More Important than the EPS Growth for 2023 Stock Returns

Chart I

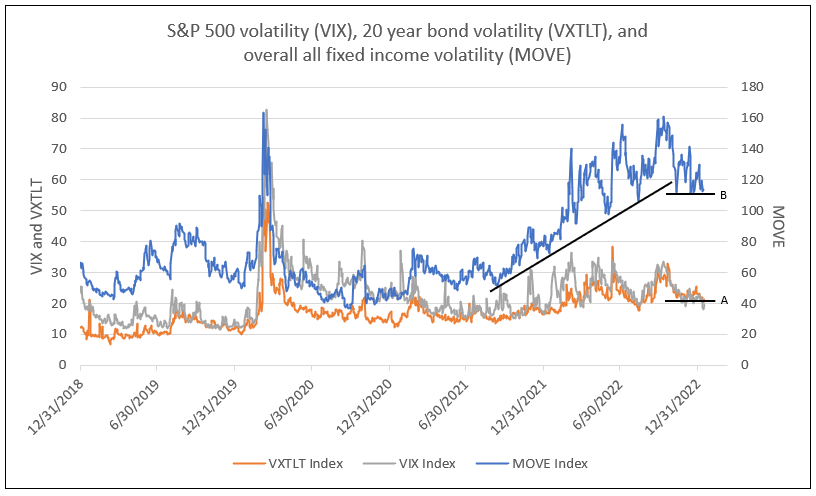

For a strong stock market in early 2023, VIX must decline below 20, toward 15. VIX is currently at 19.7. Since fixed income volatility controls the VIX, volatility on the 20-year Treasury ETF (VXTLT) must also decline below 21 (See A, Chart I). VXTLT is currently 21.4.

Most importantly, Bank of America ICE fixed income volatility (MOVE index) must decline below 111 (See B, Chart I). MOVE is currently 113.55. A decline below 111 forecasts an index of 80, a change in Fed tightening policy, and a bull market in equities.

If the VXTLT and MOVE indices decline below these respective resistance levels, that would confirm a decline in VIX and a resumption of the bull market. Alternatively, without confirmation of fixed income volatility and a decline in VXTLT and MOVE below the resistance levels, it suggests the increase in the stock market is merely a rally in a bear market.

A break below 111 in the MOVE index forecasts an index decline to 80, a VXTLT and VIX of 15 to as low as 12. The decline in VIX from 19 today to 15 or 12 forecasts a strong recovery in equities, potentially reaching old highs.

With the MOVE currently at 113, the jury is still out.

To inquire about any of IDC’s valuation products and services, please contact jer@idcfp.com or info@idcfp.com or call 262-844-8357.

John E Rickmeier, CFA

President

Robin Rickmeier

Marketing Director