Recession Now Forecast in Late 2023 - Will it be Major or Mild?

Fed’s Yield-Curve Barometer Starts Flashing Recession Risk1

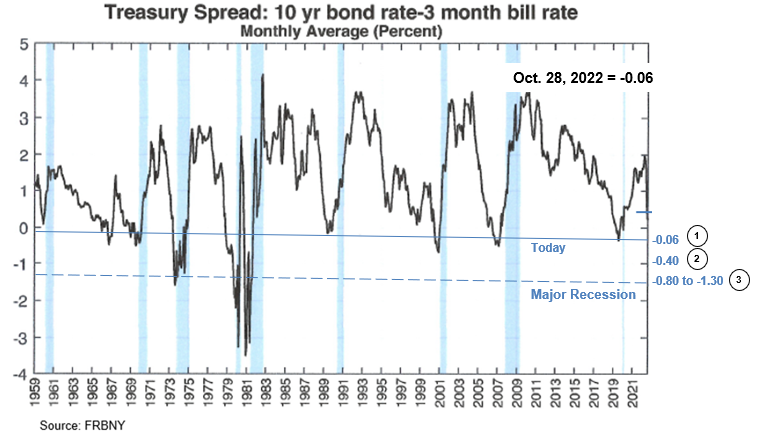

“A classic recession warning is flashing in the US Treasury market, where the 10-year note’s yield fell below the three-month bill’s”, It’s a rare occurrence, and it signals investors anticipate dire economic consequences of the Federal Reserve’s campaign against inflation. 1

Prior to brief, smaller inversions on October 25 and in early August, the 10-year dipped 0.08 percentage point below the three-month in US trading on October 26. The day’s lows for both yields were reached shortly after the Bank of Canada raised its policy rate by half a percentage point, which was less than expected.

“Inversions of this segment of the Treasury curve typically occur late in Fed tightening cycles as three-month bills track the policy rate while longer-term borrowing costs reflect expectations for economic growth and inflation.” Other yield curve segments such as the 2- to 10-year and 5- to 30-year have been deeply inverted for much of this year, but the Fed follows the 3-month- to 10-year spread more closely. 1

“We are certainly in territory with the Fed’s official barometer of the yield curve that will raise concerns,” said Gregory Faranello, head of US rates trading and strategy at AmeriVet Securities. “The Fed will definitely watch this, and there is a sense in the bond market that they will soon throttle back the pace of rate hikes and take a step back.” 1

Another three-quarter-point hike by the Fed from the current 3% to 3.25% range is still expected for next week’s policy meeting. Traders are divided on whether the subsequent move will be 50 or 75 basis points in December.

While the prospect of more Fed hikes maintains upward pressure on T-Bill yields, the 10-year, which previously peaked at 4.34%, has declined to 3.96%. Persistent strength in the economy and low unemployment should maintain the 10-year above 3.83%. A drop in the 10-year below this threshold to 3.50% or less, with the potential for an increase in the T-Bill yield to 4.30% or higher, forecasts a severe recession.

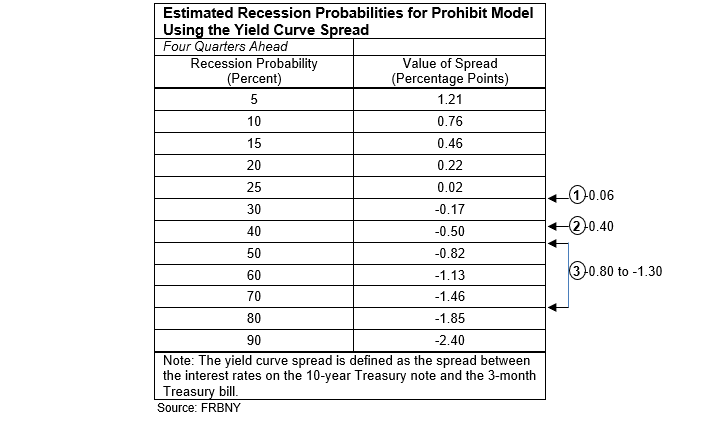

Table I

Spread Forecasts

- The current T-Bill Yield is 4.04 versus the 10-year yield of 3.98, or a spread of -0.06 basis points.

- A Fed funds rate to 75 and then 50, with the T-Bill yield at 4.60 versus the 10-year yield at 4.20, or s spread of -0.40 basis points.

- Fed funds rate to 75 and then 50 followed by major recession – the T-Bill yield at 4.30 and the 10-year yield declines to 3.5% or 3.0% or a spread of -0.80% to -1.30%.

Chart I

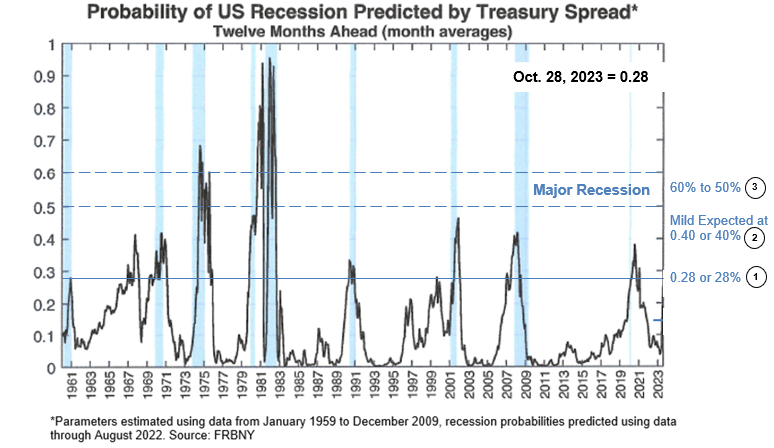

Chart II

Chart III

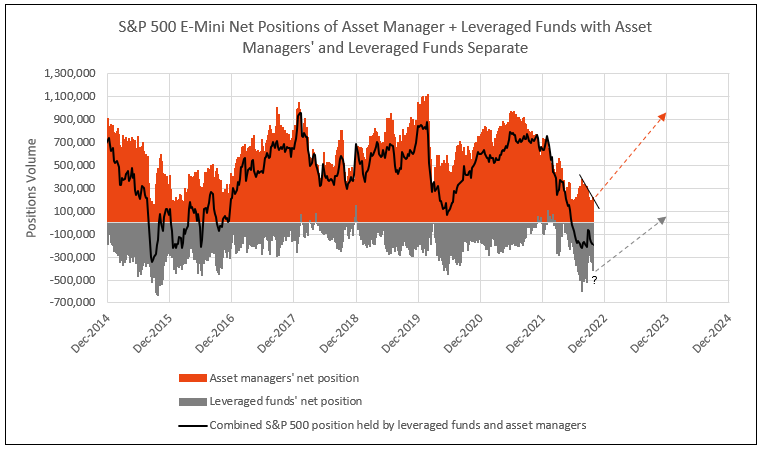

- Asset managers’ net position is decelerating. An upside breakout to the declining trend is necessary to restart a bull market.

- Leveraged funds’ net position is more negative and looking for another low, which, with the asset managers’ breakout, signals the next bull market.

- The current period is similar to late 2015 and early 2016.

1 Fed’s Yield-Curve Barometer Starts Flashing Recession Risk, Bloomberg, 10/26/2022

To inquire about IDC’s valuation products and services, please contact jer@idcfp.com or info@idcfp.com or call 262-844-8357.

John E Rickmeier, CFA

President

Robin Rickmeier

Marketing Director