Does a Rise in Interest Rates and Decline in Housing Prices Create Risk in Banks Issuing Brokered CDs?

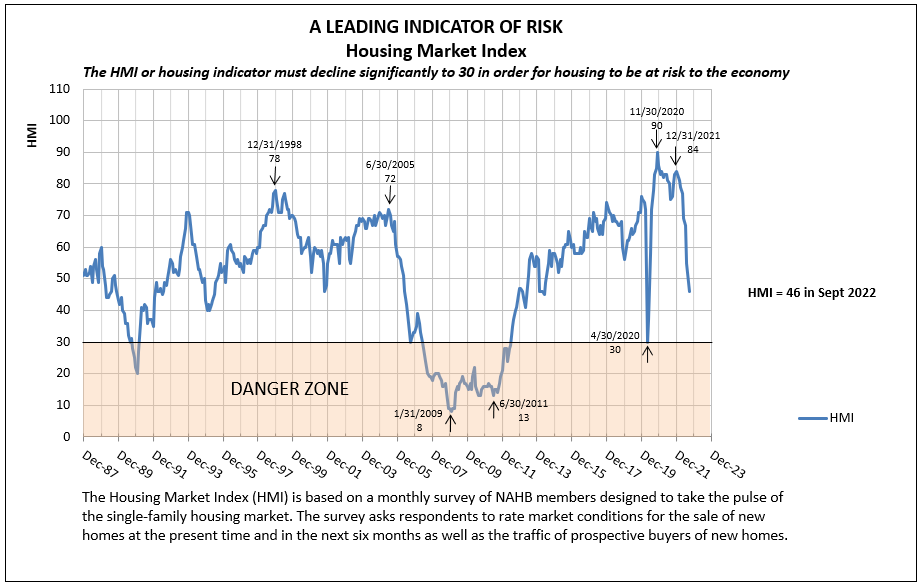

The best indicator of risk in housing is the Housing Market Index (HMI). The index forecasts expansion in housing with readings above 50 and contraction when readings are below 50. An index of 30 or less has historically indicated recession and a major housing downturn. This has in turn affected the safety and soundness of the banking system, as in 1990, and from 2006 to 2010 (see Chart I).

Chart I

The Correlation of HMI to Bank Risk

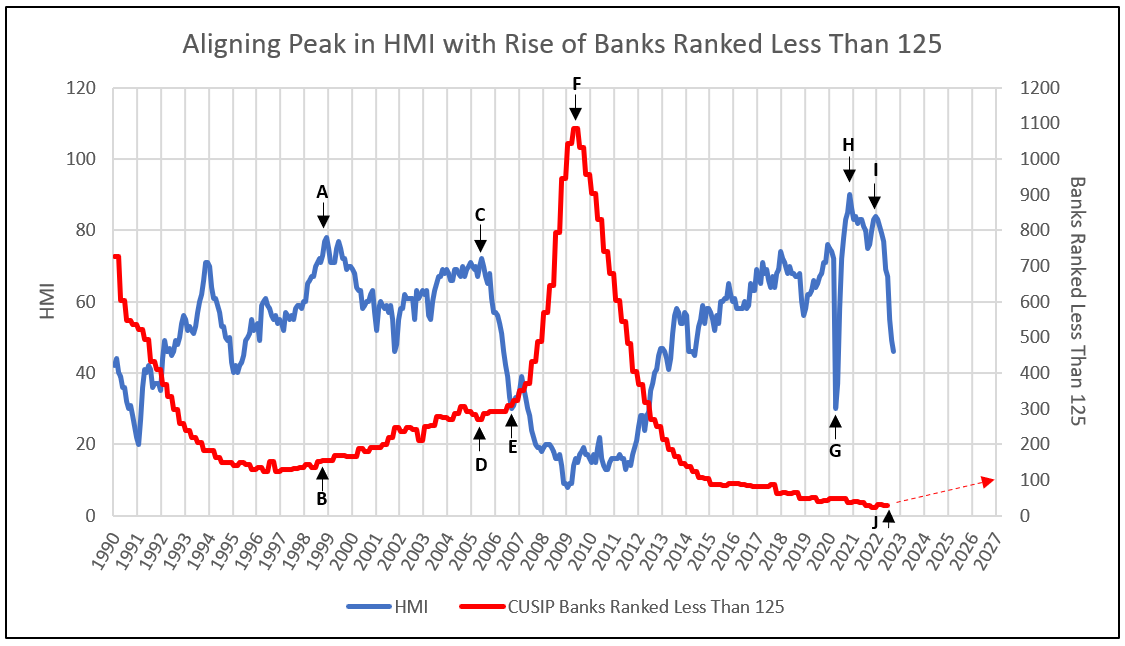

The decline in HMI from its peak of 78 (A) at year-end 1998 forecast the start of the increase in the number of banks issuing brokered CDs with IDCFP ranks below 125 (B). Ranks below this level indicate risk to a bank’s safety and soundness.

The second major peak in HMI in June 2005 at 72 (C) and subsequent sharp decline to 30 in June 2006 (E) forecast the huge acceleration in banks with subpar ranks from 271 in June 2005 (D) to 1086 in June 2009 (F, see Chart II).

The question today remains whether the Fed tightening of the Fed funds rate, rise in mortgage rates to 7% plus, and a potential economic recession will recreate the risks seen in 2006 to 2010 for the banking system.

The HMI peaked at year-end 2019 and briefly fell to 30 in April 2020 (G) during the Covid crisis, but quickly recovered to a peak of 90 in November 2020 (H) due to the decline in interest rates. HMI reached a secondary peak of 86 at year-end 2021 (I) and has subsequently declined to 46 in September 2022 (see Chart II).

Unlike the 2000 to 2005 period when banks finally took on more risk, particularly with subprime mortgages, the period from 2000 to 2022 witnessed a reduction in risk. The number of banks issuing brokered CDs of $250,000 or less declined in total due to the low level in interest rates and the massive liquidity created in the Covid period of 2020 and 2021.

Not until significant increases in the Fed funds rate in 2022 did CD yields recover, followed by renewed demand for CDs and increases in the number of banks issuing CDs. Low quality banks had sufficient liquidity, bank regulation improved since the bank failure period 2008 to 2010, and prior excesses were not repeated. Therefore, the number of banks issuing brokered CDs ranked 125 or less remain low and stable at 29 (J, See Chart II).

Chart II

HMI Decline to 30 and Below Has Historically Caused a Steep Acceleration Banks Ranked Less Than 125 Issuing Brokered CDs of $250K or Less

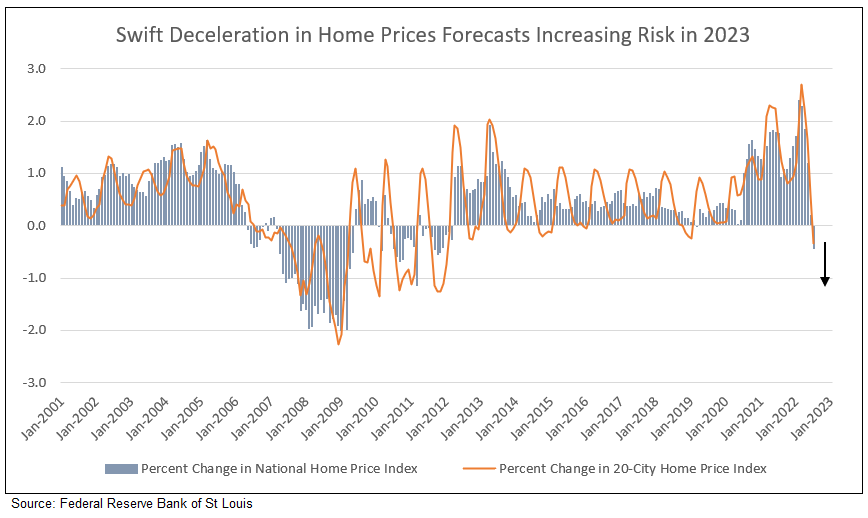

Chart III

Currently, housing prices are declining, falling 0.98% in August from a month earlier, following a 1.05% drop in July, according to mortgage provider Black Knight.1 This sharp decline in home prices, which is more rapid than that of 2007-2008, indicates risk in mortgage lending (see Chart III).

The Yield Curve as a Predictor of Recession Forecasts Low Probability of Recession in 20232

The Federal Reserve Bank of New York in a June 1996 study noted “one of the most successful models in our study estimates the probability of recession four quarters in the future as a function of the current value of the yield curve spread between the 10-year Treasury note and the 3-month Treasury bill.”

This current critical yield spread is 55 basis points, indicating a 10 to 15% probability of recession. In the recent past the spread ranged from 46 to 76 basis points, also forecasting a 10 to 15% probability. The spread would be required to turn negative to reach a 30% or higher probability of recession one year ahead in 2023.

Table I

Chart IV

Chart V

Conclusion

The continued decline to 30 in HMI is expected by November 2022. Given the Fed decides to increase the rate once more in November, and, hopefully, pause to evaluate the impact on inflation and the potential for economic weakness, thereby allows HMI to recover in 2023. However, if the Fed decides to extend the level of rate hikes to 4% or above, HMI could decline below 30 in 2023. Given the limited number of banks issuing brokered CDs, the number of banks issuing brokered CDs $250K or less and ranked less than 125 would then recover from 29 today to an estimated 100 by 2024 (see Chart II).

1 – Black Knight

2 – Tom Lee First Word, Fundstrat, Oct 3, 2022.

For further information or to view our products and services please feel free to visit our website at www.idcfp.com or contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director