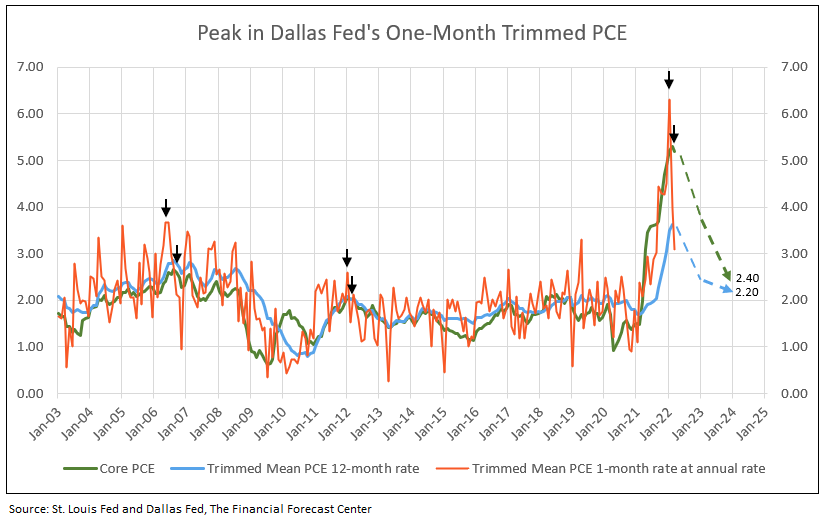

Core PCE Peaks and Forecast to Decline Through 2023

Core PCE peaked in February and is forecast to decline to under 4% in 2022, and 2.4% by year-end 2023. Month-to-month trimmed mean PCE leads core PCE inflation, peaking in January 2022 and declining to 3.1% in March.

Chart I

Month-to-Month Trimmed Mean PCE Peaked in January 2022 and Forecasts Year-Over-Year to Decline to 2.2% by Year-End 2023

The Trimmed Mean PCE inflation rate is an alternative measure to sticky inflation in the price index for personal consumption expenditures. It is calculated by staff at the Dallas Fed, using data from the Bureau of Economic Analysis (BEA).1

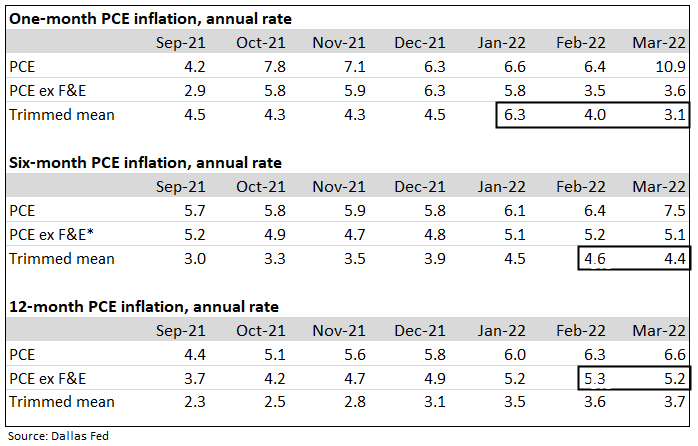

Trimmed mean PCE inflation measured month-to-month peaked in January at a 6.3% annual rate, fell to 4.0% in February and 3.1% in March. The six-month annualized rate peaked in February at 4.6% and declined to 4.4% in March. The 12-month rose by 0.1% in March to 3.7% and is forecast to recede to 2.2% with core PCE at 2.4% by 2023, an acceptable rate of inflation for the Fed (see Table I).

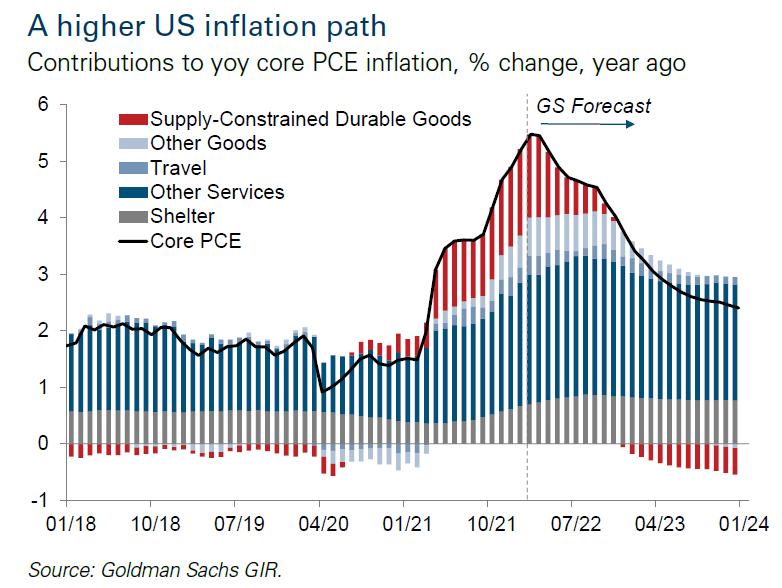

Core PCE Inflation Forecast

Goldman Sachs economists forecast core inflation (PCE) to fall under 4% by year-end 2022 from 5.2% currently and decline to 2.4% by the end of 2023 (See Chart II).2

- “Supply-constrained” goods swing from being a major contributor to inflation in the second half of 2021 and the first quarter of 2022 to a deflator in 2023, thereby reducing core PCE in late 2022 and the year 2023 by as much as 40 basis points.

- Auto-related CPI contribution was 197bp of the 393bp rise in core CPI and is now narrowing significantly.

- The increase in shelter contribution peaks at 90bp by mid-year 2022 and moderates to 80 bp by year-end 2023.

Chart II

Table I

Trimmed Mean PCE Inflation Rates

Wages Become a Sticky Factor

Employment costs surged in the first quarter, up 1.4%, and 4.5% from a year ago. Wages and salaries advanced 4.7%, benefits rose 4.1%. Excluding government, private wages increased 5% from a year earlier. The wage contribution to inflation depends on productivity, unit labor cost increases, and resulting product price inflation to offset higher costs.

Still, inflation-adjusted spending has increased over the last three months despite a 6.6% jump on PCE price index, signaling consumers continue to make purchases in the face of rising prices.

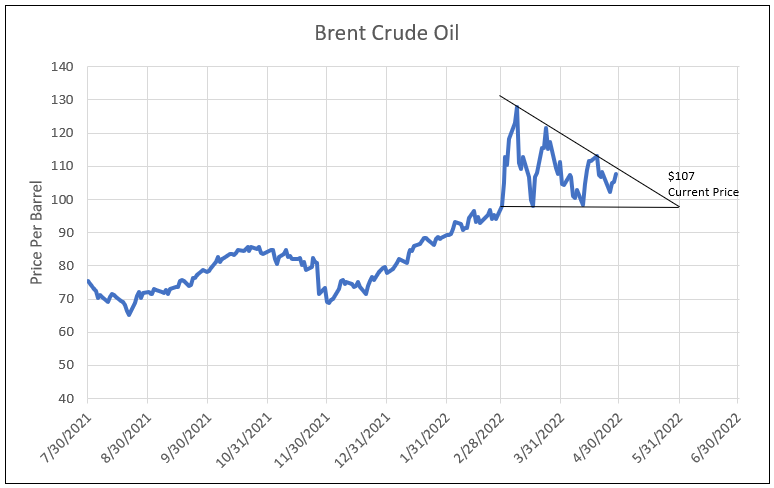

Decision Time for Crude Oil Price Outlook – “The Key Component of Non-Core Inflation”

Brent crude oil currently trades at $107 a barrel with December futures at $98. Citicorp’s bearish oil strategist Ed Morse forecasts the Brent crude oil price of $69 a barrel in December 2022 based on some of the following reasons.3

- Iran - Citi sees Iran adding 500kb/d by the second quarter of 2022 and another 800kb/d by year end, with additional gains in 2023.

- Shale - Citi sees approximately 1mb/d of U.S. production growth this year, and approximately 2mb/d of production growth annually at $90 oil.

- Demand – Citi sees demand easing in the fourth quarter.

- Oil "intensity" - Citi notes that GDP growth drives oil demand; however, falling "intensity" of oil as a percent of GDP will soon hit EM demand growth.

Counterpoints to Citi’s argument include negotiations with Iran remain unresolved with additional supply postponed. Additionally, several producers indicate no increase in production in 2022, plus trend demand growth from 2019 to 2022 would put global demand above 103 mb/d, higher than Citi estimates. Finally, Goldman Sachs indicates, if Russian oil is fully embargoed, the price of oil would rise to $240/b by this summer.3 Germany has said it will not block an embargo on Russian oil by the European Union, in a shift that could see the country phase in an end to purchases from Russia.4

Mitigating arguments to the Goldman Sachs oil embargo price forecast include a number of countries elected to pay for Russian natural gas in rubles. Germany plans to support gas shortfalls in Poland and other countries. Natural gas pipelines are being built from Greek ports. In addition, an EU oil embargo, phasing out crude purchases from Russia by year-end 2022, could reduce EU crude flows from 0.8 million barrels a day to zero. The current flow of 0.8 is down from 1.3 million barrels per day prior to the Russian invasion of Ukraine, a 0.5 reduction already in 2022. With the lack of success in the Russian military and European countries and the U.S. sending heavy armaments to Ukraine, a potential stalemate could occur.

In conclusion, forecasting near-term crude oil prices in the face of supply disruptions is difficult, as is Citi’s call for $69 December futures Brent oil price challenging.

Let the Brent price forecast the future (see Chart III).

A. A rise above $110 and then higher than $130, more energy inflation.

B. A decline below $99, less energy inflation.

Chart III

1 The Federal Reserve Bank of Dallas

2 Tom Lee’s Insight of Fundstrat letter from April 25, 2022

3 Citi calls for oil prices to fall 50%+ by year end, Rystad sees upside to $240 oil

4 Bloomberg, April 29, 2022

To view all our products and services please visit our website www.idcfp.com. For more information about our ranks, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director