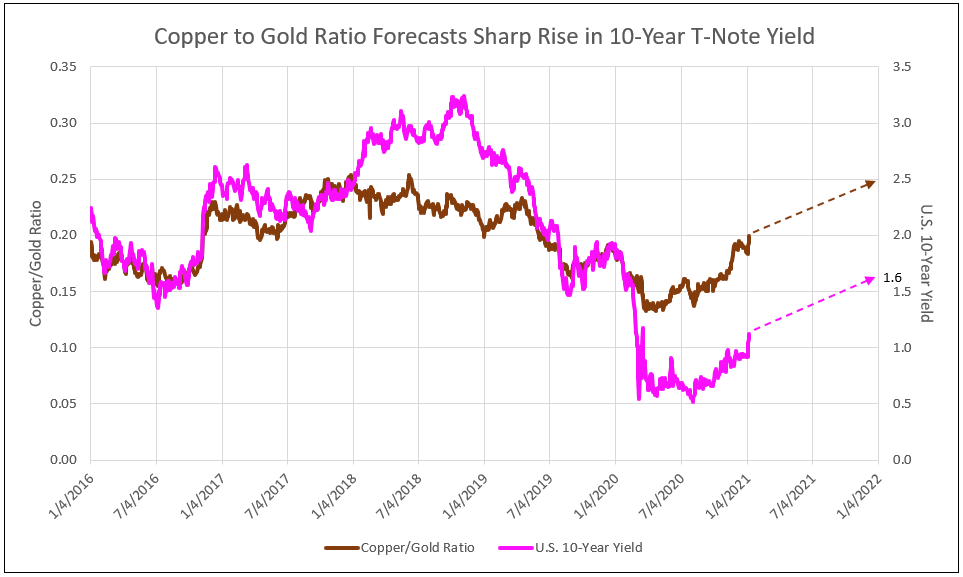

U.S. 10-Year Yield Breaks Out Above 1%, Forecast to Increase to 1.6%

The copper to gold ratio has historically been the best forecast for the U.S. 10-year yield. The positive correlation between the two is extremely high, but discrepancies have occurred. As seen in Chart I, from early 2018 to August 2019, during the “tariff wars” and falling German yields, the U.S. 10-year yield declined at the same time the Federal Reserve raised the Fed Funds rate, causing a negative correlation. Deviation in the correlation appeared again in 2020 as a result of COVID-19 and the Federal Reserve’s adoption of a near-zero short-term rate.

Chart I

The value of the copper to gold ratio is not as important as its trend. Since August 2020, this ratio rose predicting a higher U.S. 10-year yield. While stalling in November and December 2020, the ratio in early 2021 broke out to new highs to .20 and the 10-year yield rose above 1.00% (see Chart I).

Copper prices represent the strength in the economy and anticipate future growth. Gold prices are an expected hedge against inflation. The advent of vaccines to cure COVID-19, the pent-up demand for goods, and now the Democratic Party control in Government all forecast strong economic growth with more inflation. Yet copper prices rose more than gold.

We forecast the copper to gold ratio to rise to 0.25 by year-end 2021. The increase in the 10-year yield is expected to match this trend, rising to 1.6 % by year end. At such time in 2022 or 2023 when the Fed changes its current monetary policy, the U.S. 10-year would then rise again to the level forecasted by the copper to gold ratio.

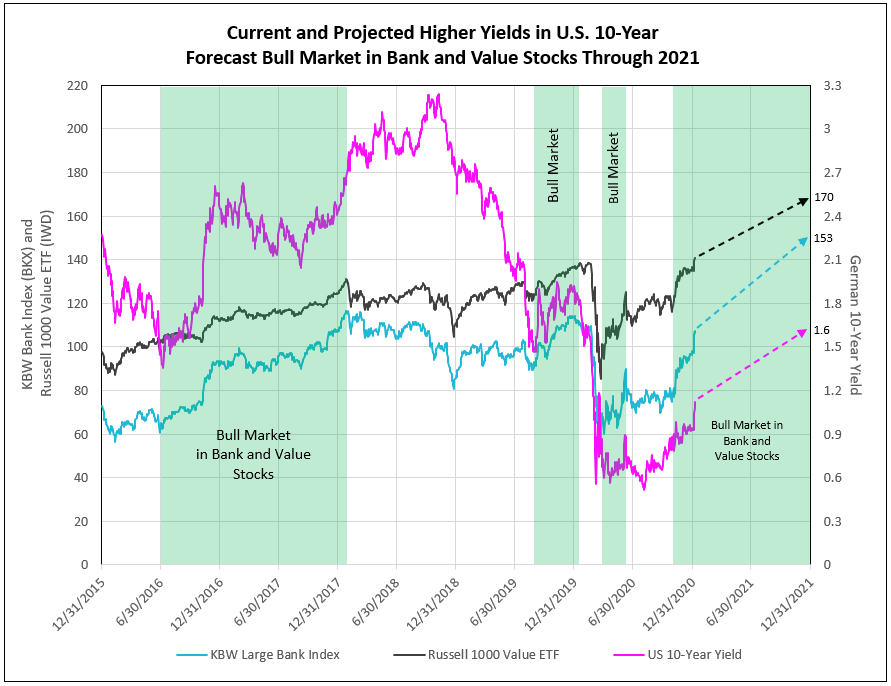

It is a reasonable expectation for the 10-year yield to increase to 1.6% in 2021. Even more important is the significant increase to the 30-year bond yield to 2.40% by year-end 2021 and then to as high as 3.5% by 2023. Bank stocks will outperform value stocks and the S&P 500 over this extended period.

There are several contributing factors driving future bank stock performance. These include a rising U.S. 10-Year treasury yield to 1.6% under a Biden administration with Yellen as Treasury Secretary, a widening yield curve, favorable operating earnings to be reported in January and throughout 2021, reversal of overly cautious loan loss provisions under CELA adding to operating earnings, and the return of stock buybacks.

Bond prices fall as yields rise, creating a major bear market in the U.S. bonds. Bank stocks that benefit from rising bond yields, with current dividend yields near 2.75% and more than a 40% appreciation potential, become a fixed income alternative (See Chart II).

For further reading on this topic, refer to the article IDC Financial Publishing (IDCFP) published on August 31, 2020, discussing the extreme undervaluation of bank stocks to their normal valuation. We forecast the potential future appreciation potential for JP Morgan and other bank stocks. Additionally, on October 19th and November 9th, 2020 we wrote about the coming bull markets in both large and regional bank stocks.

Chart II

To view all our products and services please visit our website www.idcfp.com.

For more information about our ranks, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director