Concern Over Rising Inflation

It may seem odd to discuss concerns over inflation in the midst of a global pandemic and consequent recession, however, there are many signs pointing to a not-so-distant severe rise in inflation. Once Covid-19 has resolved and there is wide distribution of a vaccine, demand will increase in our economy that we now assume has multiple supply constraints.

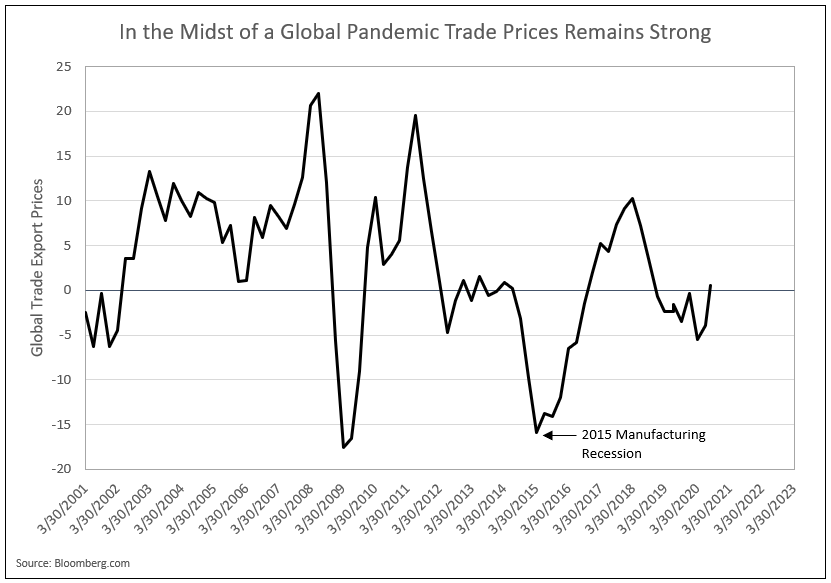

While it is historically difficult to forecast inflation, we are seeing signs of its inevitability. As Chart I shows, since the onset of Covid, the trade prices have not fallen even as much as during the manufacturing recession in 2015 (see Chart I).

Chart I

In a recent article published by Bloomberg, Richard Cookson, who was head of research and fund manager at Rubicon Fund Management, discusses the inevitability of rising inflation, stating “prices are now rising strongly, in part because Asian growth is humming. Chinese export prices have risen year over year. Excluding oil, industrial commodity prices are also now higher than they were at the end of last year. Even if nothing moves between now and late spring of 2021, year-over-year comparisons will start to look very dramatic — as prices this spring were at their low point. These trends are already making themselves felt in the developed world. U.S. import prices, for example, are rising strongly. Durable goods prices are on a tear. There are signs that services inflation is also rising.”1

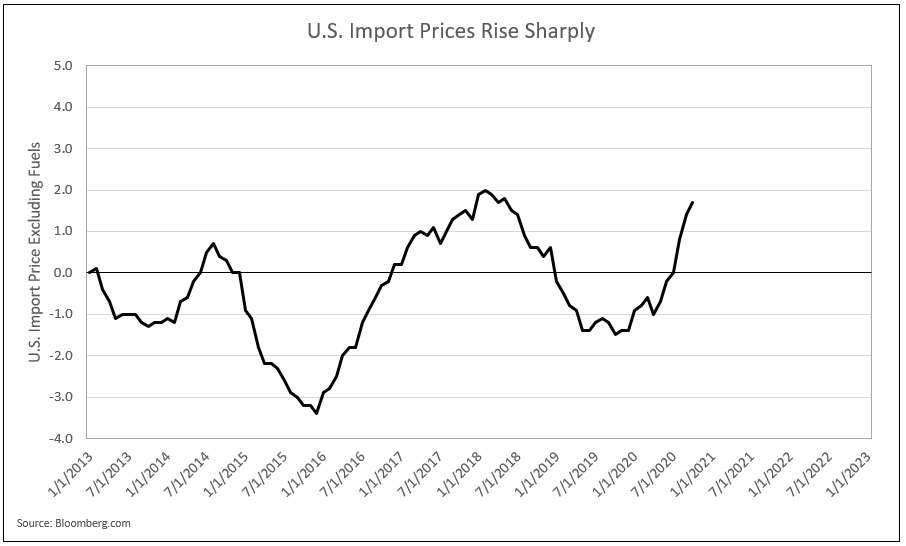

Chart II

Cookson further states that demand is still subdued because we remain in the midst of a pandemic, but when a vaccine becomes available or the virus “blows itself out,” this trend will reverse. Demand will be renewed, yet the resources to meet that demand have been severely constrained and simultaneously become more expensive, particularly in the manufacturing and transportation sectors.1

“Assuming that all this takes a fairly long time to get up and running, you would expect these constraints to last. The same is probably true of services. A lot of companies have already been put out of business and many more are likely to go to the wall. There has been, then, severe losses to economies’ supply potential. All of which means that the path of least resistance when demand picks up is higher prices.”1

With the exception of oil, industrial commodity prices are higher than they were at the end of 2019, and as a result, U.S. import prices are affected and also increasing rapidly in the latter half of 2020 (see Chart II).

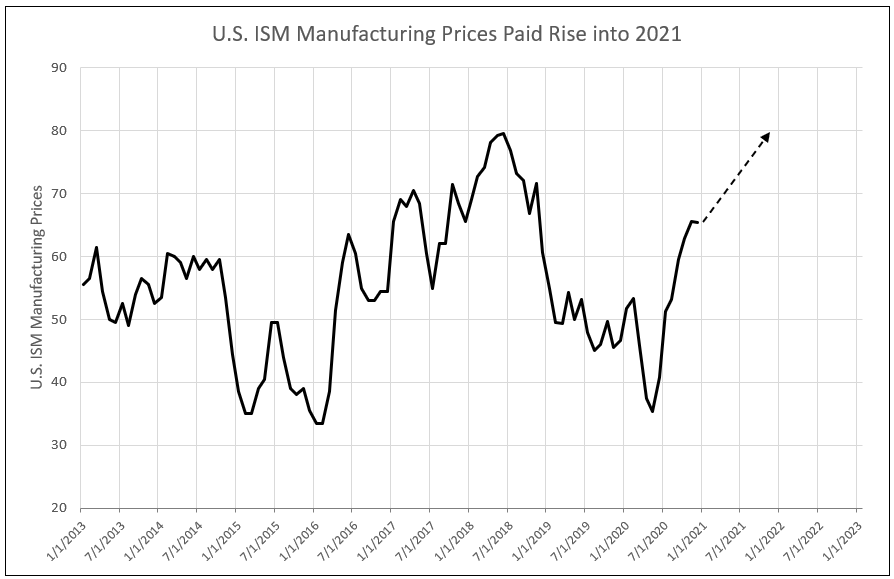

The Evidence in Trade, Manufacturing and Non-Manufacturing Prices

There is evidence that the rise in trade prices are being reflected in manufacturing prices. Next year manufacturing prices paid index could go to 80 or above, exceeding the 2018 peak levels (see Chart III).

Chart III

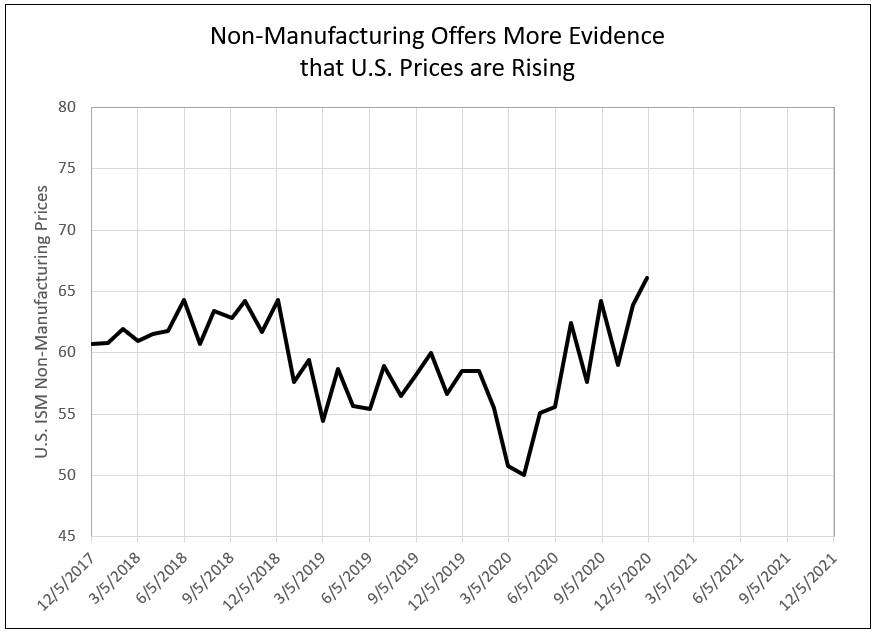

Non-manufacturing prices paid rose to a new 3-year high, as reported in November 2020. Given the trend in import trade and import prices, non-manufacturing ISM prices paid could well reach 70 or higher in 2021 (see Chart IV).

Chart IV

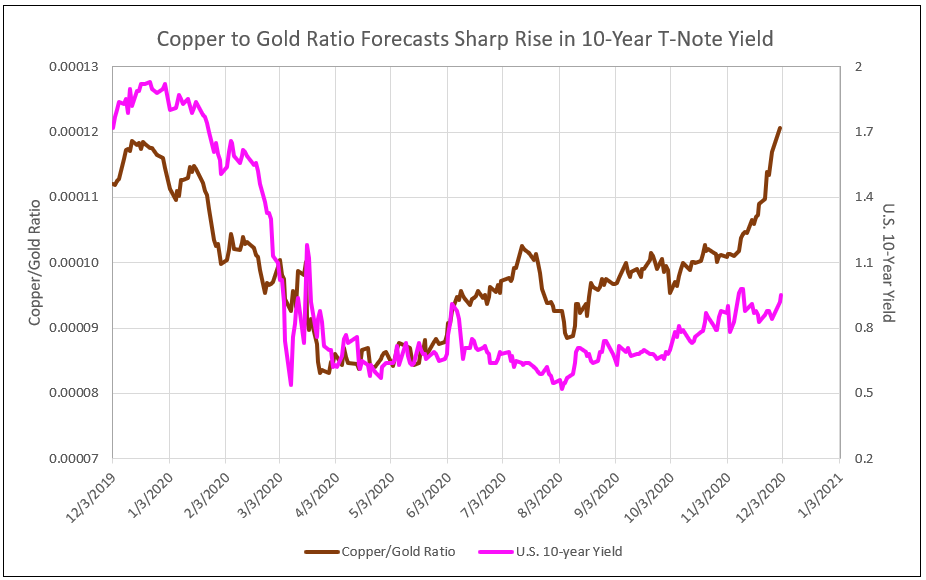

The absolute level of the copper to gold ratio is not as important as the movement in the ratio relative to the 10-Year T-Note yield. Whole the ratio has accelerated in 2020, the 10-year failed to surpass the high in November (see Chart V).

Chart V

Five Reasons to Worry About Faster U.S. Inflation

Bill Dudley, a Senior Research Scholar who served as president of the Federal Reserve Bank of New York from 2009 to 2018, recently stated in his article for Bloomberg Five Reasons to Worry About Faster U.S. Inflation, “A lot of people believe that inflation in the U.S. is dead or, if not dead, in a state of suspended animation for the foreseeable future. They could be setting themselves up for an unpleasant surprise.”2 He suggests inflation could come back more rapidly than the consensus suggests due to the following:

“First, the onset of the pandemic in March and April drove prices down sharply…This has depressed year-over-year readings of inflation. But after April 2021, the lower readings will become the new basis for comparison, and year-over-year measures of inflation will jump.

Second, the development of effective vaccines will allow people to return to their normal spending patterns by the second half of 2021. The leisure and hospitality…will probably regain pricing power as demand recovers. Sharp price increases might even be needed to balance demand with the available supply, which the pandemic has undoubtedly diminished.

Third, the lingering effects of the pandemic will make it difficult for companies to meet increased demand by simply producing more with the same people and capital…Many workers will have left the hardest-hit sectors, making it difficult for businesses to find the labor needed to expand. Some businesses, such as restaurants, will simply have disappeared, reducing the capacity available to meet resurgent demand.

Fourth, the Fed has revised its long-term monetary policy in a way that allows for more inflation. Previously, the central bank aimed to hit its 2% target regardless of how far or how long inflation had strayed from that objective in the past. Now the Fed wants inflation to average 2%, which means it will have to exceed 2% for a significant time to offset the chronic downside misses that have accumulated over the past decade.

Fifth, the government is much more likely than it used to be to support the economy with added spending…Instead of worrying about rising federal debt burdens, economists now see much greater scope for aggressive action to offset significant shortfalls in demand. As a result, the government probably won’t want to remove fiscal stimulus as quickly as it did after the 2008 financial crisis (a move that led to a disappointingly slow recovery).

All told, inflation might be a greater danger precisely because it’s no longer perceived as such. Policy makers want to push it higher. Most households and businesses are not concerned about the risks. Once the pandemic abates, those risks will no longer be entirely on the downside. And given how completely financial markets have come to expect low inflation and interest rates, and how much support those expectations are providing to bond and stock prices, an upside surprise could prove nasty.”2

Inflation Today as Priced by the U.S. 10-Year Treasury

The bond market is implying 1.8% inflation, but the outlook from export prices, import prices, manufacturing and non-manufacturing prices paid, and rising copper prices relative to gold, all forecast a dramatic rise in inflation in 2021 into 2022. Initially, the forecast of the US 10-year yield of 1.5% seems reasonable, up from 0.95%. However, a sudden acceleration in inflation could increase the 10-year yield to 2% or higher.

1 Brace Yourself for a Sharp Rise in Inflation, Bloomberg.com

2 Five Reasons to Worry About Faster U.S. Inflation, Bloomberg.com

To view all our products and services please visit our website www.idcfp.com.

For more information about our ranks, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director