Our Estimate of Total Brokered CDs Less Than $250K For Each Bank

Balances on Sweep Accounts Rise Dramatically to Over $695 Billion

As a broker, would you be interested to learn about new banks or credit unions as potential issuers of brokered CDs to capitalize on this forecast? Would it be helpful to see the characteristics of these institutions, such as loan to deposit ratio or loan growth, that could be applied to similar institutions?

IDC Financial Publishing, Inc. (IDCFP) has developed a method to estimate brokered CDs less than $250,000, issued by banks or credit unions, using our databases. In the following article, we describe this process and how this information can be used to discover new prospects.

In the first quarter of 2020, IDCFP analyzed all 5,150 banks in our Deposit Database and determined which institutions reported brokered deposits, reciprocal deposits, brokered CDs $250K or greater, and insured brokered deposits. In reviewing the quarterly changes in insured brokered deposits and comparing that to the change in time deposits, IDCFP can isolate brokered CDs less than $250K and the value of sweep accounts for each bank.

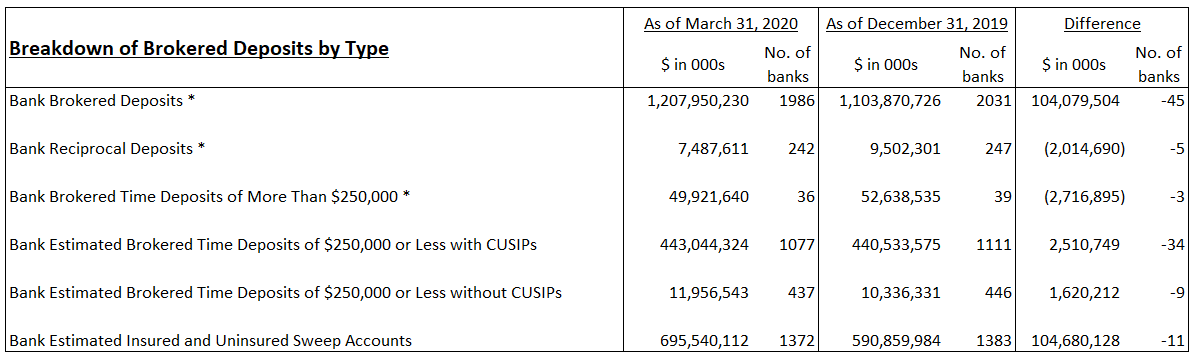

Table I

* As reported on regulatory Call Report.

Following are the takeaways from IDCFP’s Deposit Database for commercial and savings banks.

- Brokered deposits rose $104 billion from year-end 2019 to March 31st, 2020, due to the significant increase in sweep accounts.

- Bank reciprocal deposits and large brokered CDs over $250,000 both declined in the first quarter of 2020.

- Brokered CDs with CUSIPs, estimated by IDCFP, rose $2.5 billion to $443 billion, while the number of issuing banks declined by 34.

- IDCFP’s estimate of bank sweep accounts rose $104.7 billion to a record high of $695.5 billion, more than half of all brokered deposits. The huge stock market decline from February 19th to March 23rd created a large pool of liquidity, reflected in the quarter-end balances of sweep accounts.

From IDCFP’s deposit database, you can determine key information on brokered CDs:

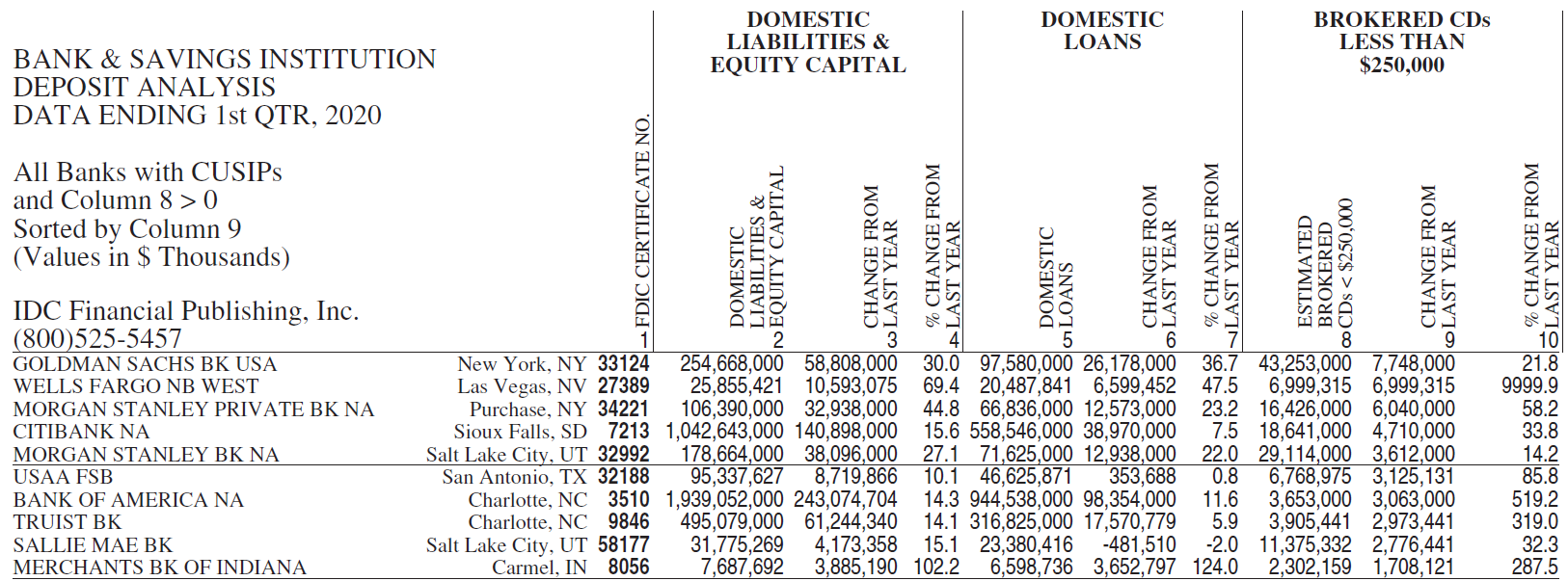

- The total amount of estimated bank brokered CDs less than $250K (Table II & III, Column 8) and the dollar and percentage change over the last year (Table II & III, Columns 9 & 10) in each domestic bank with or without CUSIPs.

- The estimated sweep accounts and reported reciprocals and brokered CDs $250K or greater for each bank.

- Characteristics of domestic banks that issue brokered time deposits with CUSIP IDs can be used to determine other domestic banks as potential issuers. Characteristics for all domestic banks include the loan to deposit ratio, loan growth in dollars and percentages, and other pertinent ratios.

- For access to all deposit data, please send inquiries to info@idcfp.com or visit www.idcfp.com.

Table II

Sample of Largest Total of Brokered Time Deposits Less than $250K

Table III

Sample of Largest Dollar Increase in Brokered Time Deposits Less Than $250K Over the Past Year

IDCFP has been helping CD brokers and investors, insurance companies, federal agencies, numerous state governments and a host of other institutions make better decisions using our database and proprietary CAMEL rating methodology since 1985.

To view all our products and services please visit our website www.idcfp.com.

For more information about our Deposit Database, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director