Our Estimate of Total Brokered CDs Less Than $250K For Each Bank and Credit Union

IDCFP forecasts an increase of 28% from the $447 billion balance at the end of December 2019, to reach $570 billion by year-end 2022.

As a broker, would you be interested to learn about new banks or credit unions as potential issuers of brokered CDs in order to capitalize on this forecast? Would it be helpful to see the characteristics of these institutions, such as loan to deposit ratio or loan growth, that could be applied to similar institutions?

IDC Financial Publishing, Inc. (IDCFP) has developed a method to estimate brokered CDs less than $250,000, issued by banks or credit unions, using our Banks and Credit Unions Databases. In the following article, we describe this process and how this information can be used to discover new prospects.

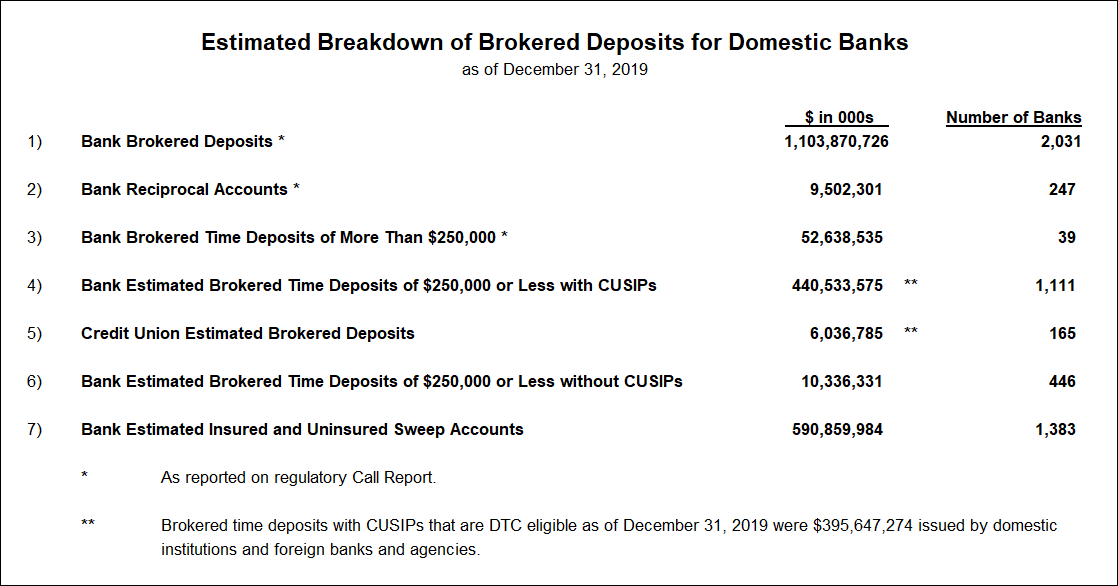

In the fourth quarter of 2019, IDCFP analyzed all 5,225 banks in our Deposit Database and determined which institutions reported brokered deposits, reciprocal deposits, brokered CDs $250K or greater, and insured brokered deposits. In reviewing the quarterly changes in insured brokered deposits and comparing that to the change in time deposits, IDCFP can isolate brokered CDs less than $250K and the value of insured sweep accounts for each bank.

Using only banks identified with brokered CDs that have a CUSIP number, IDCFP can estimate the value of eligible bank brokered CDs. Additionally, credit union brokered CDs with a CUSIP number provide an estimate of their brokered CDs from reported non-member deposits. The total of the two (lines 4 & 5 in Table I) exceeded the amount of DTC-eligible brokered CDs outstanding. The estimated difference is due to paying agent accounts that use electronic payment systems rather than DTC.

Table I

IDCFP’s estimate of individual bank and credit union brokered CDs less than $250K was $447 billion, as of December 31st, 2019. The Depository Trust Company’s eligible bank, credit union and other brokered CDs were valued at $396 billion at the end of the fourth quarter.

From IDCFP’s deposit database, you can determine:

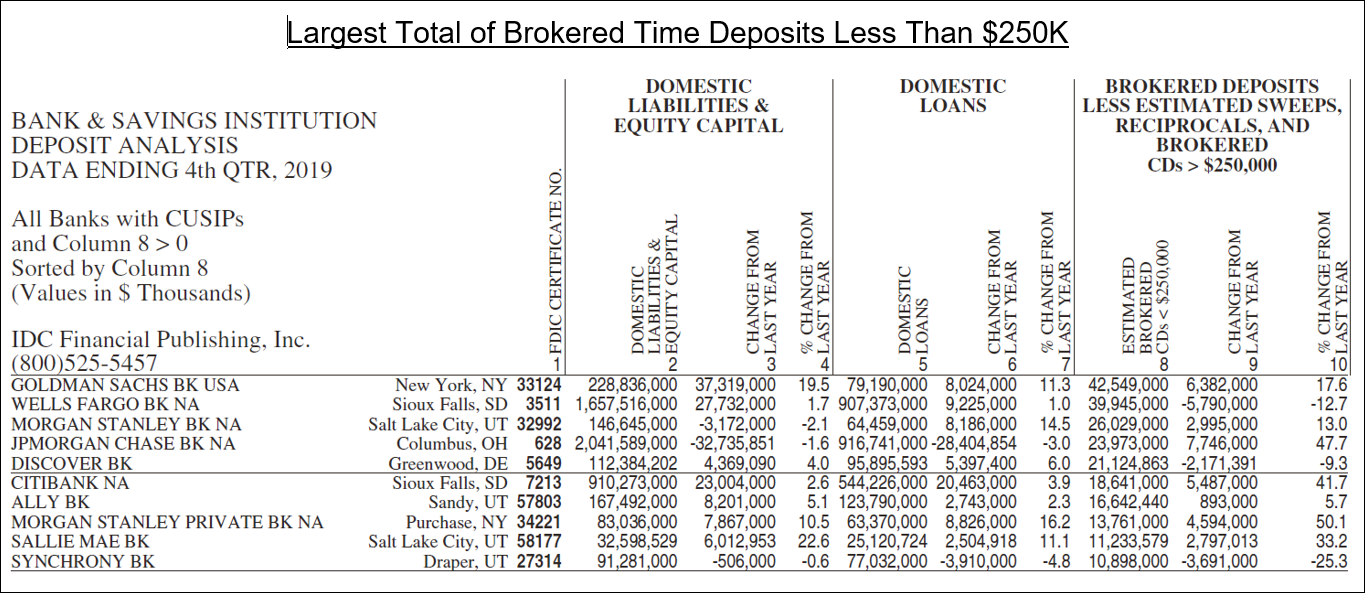

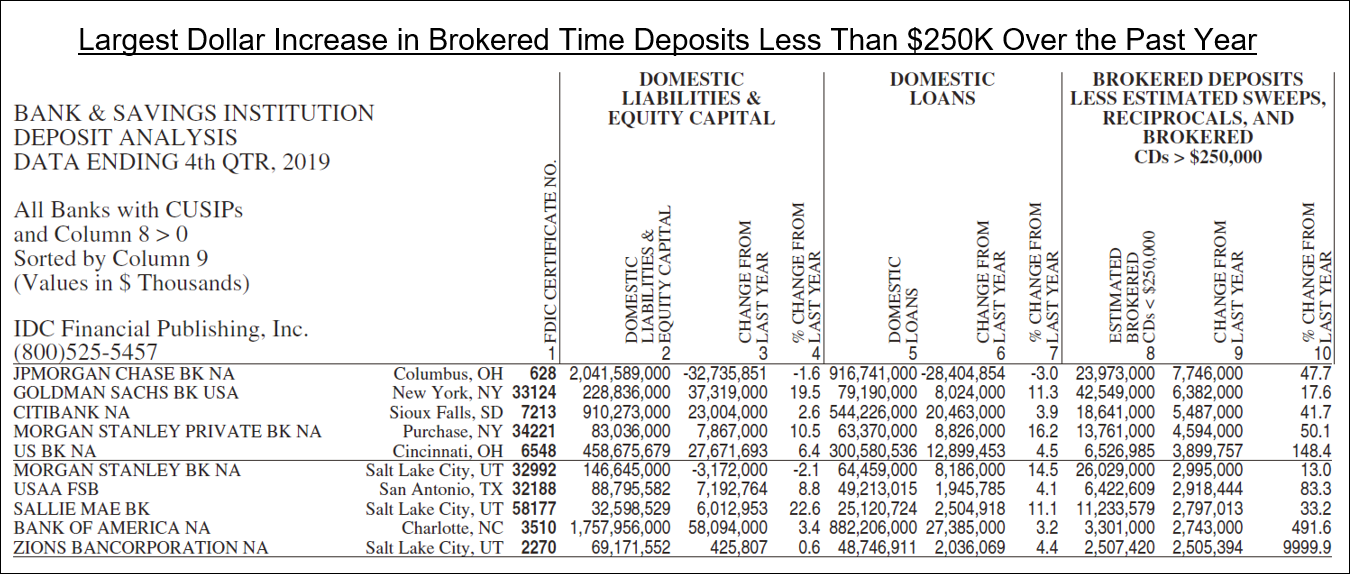

- The total amount of estimated bank brokered CDs less than $250K (Table I & III, Column 8) and the dollar and percentage change over the last year (Table II & III, Columns 9 & 10) in each domestic bank with or without CUSIPs.

- The estimated sweep accounts and reported reciprocals and brokered CDs $250K or greater for each bank.

- Characteristics of domestic banks that issue brokered time deposits with CUSIP IDs can be used to determine other domestic banks as potential issuers. Characteristics for all domestic banks include the loan to deposit ratio, loan growth in dollars and percentages, and other pertinent ratios.

- For access to all deposit data, please send inquiries to info@idcfp.com or visit www.idcfp.com.

Table II

Table III

IDCFP has been helping CD brokers and investors, insurance companies, federal agencies, numerous state governments and a host of other institutions make better decisions using our database and proprietary CAMEL rating methodology since 1985.

To view all our products and services please visit our website www.idcfp.com.

For more information about our Deposit Database, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director