Credit Unions are a Growing Force

Credit unions have grown to become a major factor in the U.S. economy. “Credit union assets have grown at nearly twice the pace of banks’ over the past decade.”1 Credit unions are owned by their members and are designed to offer lower borrowing costs and higher deposit rates. In addition, the median large credit union (greater than $50 million in assets) earned a return on equity (shares and reserves) of 6.4% and experienced 4% loan growth over the past year.

IDC Financial Publishing (IDCFP) focuses on 2,329 credit unions with more than $50 million in assets to determine the risks to the financial system. These larger institutions are using their strength to compete aggressively for business. “Credit unions now make nearly a third of U.S. auto loans, compared to 23% in 2008.”2 The group of 3,017 credit unions with assets less than $50 million remain important to the industry, but are not a major risk factor in a potential economic downturn or the overall health of our financial system.

The Risk in Large Credit Unions

IDCFP calculated the CAMEL rank of 5,346 credit unions in the fourth quarter of 2019. The 2,329 large credit unions account for 97% of total credit union assets and remain the potential risk factor in a future major economic downturn.

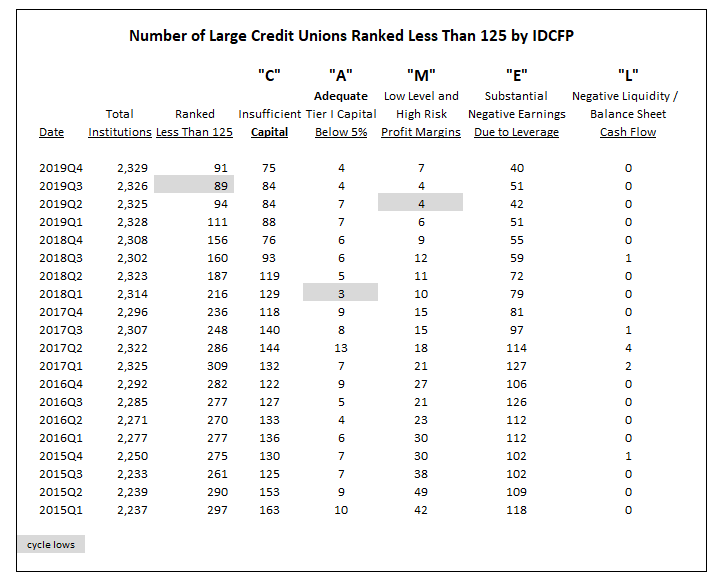

To determine this risk, we separate the credit unions ranked under 125, which is below-investment-grade and the industry standard. As of the end of the fourth quarter 2019, 91 large credit unions were ranked below 125 by IDCFP, up from 89 the previous quarter. This rise in institutions is the first risk alert, however the risk needs to be confirmed by all components of CAMEL hitting lows and rising, whereas today that is only true for the institutions with low level and high-risk profit margins.

The “C” in CAMEL, which represents “Insufficient Capital,” is at 75, down from 84 institutions the previous quarter. The “A” in CAMEL, or “Adequacy of Capital” to meet loan delinquency, reached a low of 3 in the first quarter of 2018 and is currently at 4, down from 7 in the second quarter of 2019. The number of institutions below investment grade under “E” and “L” both continue to decline. The one exception is the “M” in CAMEL, which reached a low of 4 institutions in the second quarter of 2019 and has risen to 7, therefore the sole indicator of risk.

Without an increase in the total number of large credit unions ranked below 125 and supported by all the components of CAMEL reaching lows and increasing in number, IDCFP forecasts a strong and solvent credit union industry (see Table I).

Table I

The Risk Seen in Credit Unions Prior to the 2008 Collapse

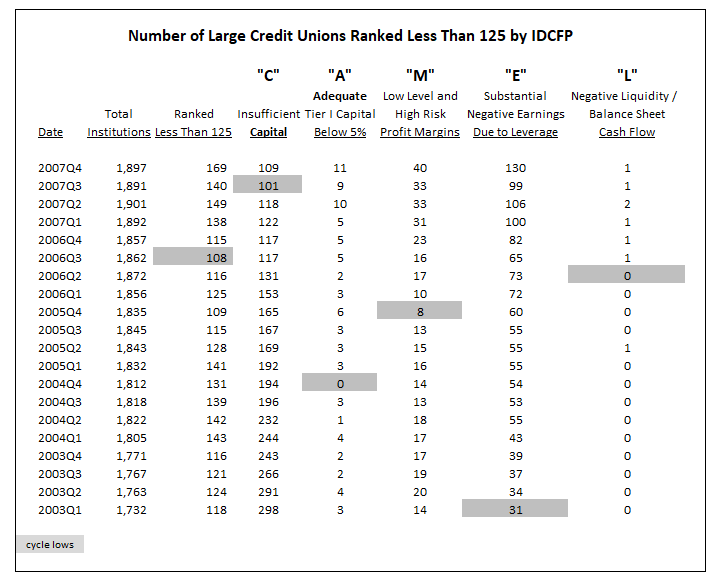

IDC successfully indicated a risk alert for the credit union industry as early as the fourth quarter of 2006, over a year prior to the financial and economic collapse of 2008 and 2009. Out of the 1,862 large credit unions in the third quarter of 2006, 108 were ranked below 125, or less than investment grade. The increase to 115 in the fourth quarter signaled the major risk alert for credit unions.

The “C” in CAMEL bottomed at 117 in the third quarter of 2006, but then recycled when it hit a low of 101 in the third quarter of 2007. The “A” low of 0 was in the first quarter of 2005, the “M” low of 8 was in the fourth quarter of 2005, the “E” low of 31 was much earlier, in the first quarter of 2003, and the “L” component of CAMEL was 0 in the second quarter of 2006.

In summary, IDCFP’s risk alert for the financial downturn of large credit unions, as well as, the entire credit union industry, was evident in the fourth quarter of 2006, successfully forecasting the financial problem to occur in 2008 and 2009 (see Table II).

Table II

1,2: How Credit Unions Outgrew Their Down-Home Reputation, Wall Street Journal, 12.3.2019

To view our products and services please visit our website at www.idcfp.com . For more information about our CAMEL ratings, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director