IDC’s Remarkable Record Predicting Bank Failure and Recovery

Updated for 1st Quarter 2019 ranks

From 1990 to 2018, there were 1,419 failures of banks. Of these, 90% (1,271 banks) were ranked less than 125 by IDCFP up to 17 months before failure. Further, 73% (1,033 banks) were rated less than 125 by IDCFP up to 29 months before a collapse. Even the Washington State Department of Financial Institutions has listed on their website “IDC has a remarkable track record of identifying deteriorating or improving performance months, and sometimes years, before it becomes apparent to other ranking companies.”

IDC Financial Publishing’s (IDCFP) CAMEL savings institution, credit union and bank safety ratings range from 300 (the top grade attainable) to 1 (the lowest). From the early 1990’s, through today, institutions using CAMEL ranks determined that ranks less than 125 were deemed below investment grade. This article discusses banks which issued brokered CDs, and how our ranking of these banks predicted institution failure, the banking crisis of 2008 to 2009, and post-crisis institution mergers. We also provide an outlook for the future.

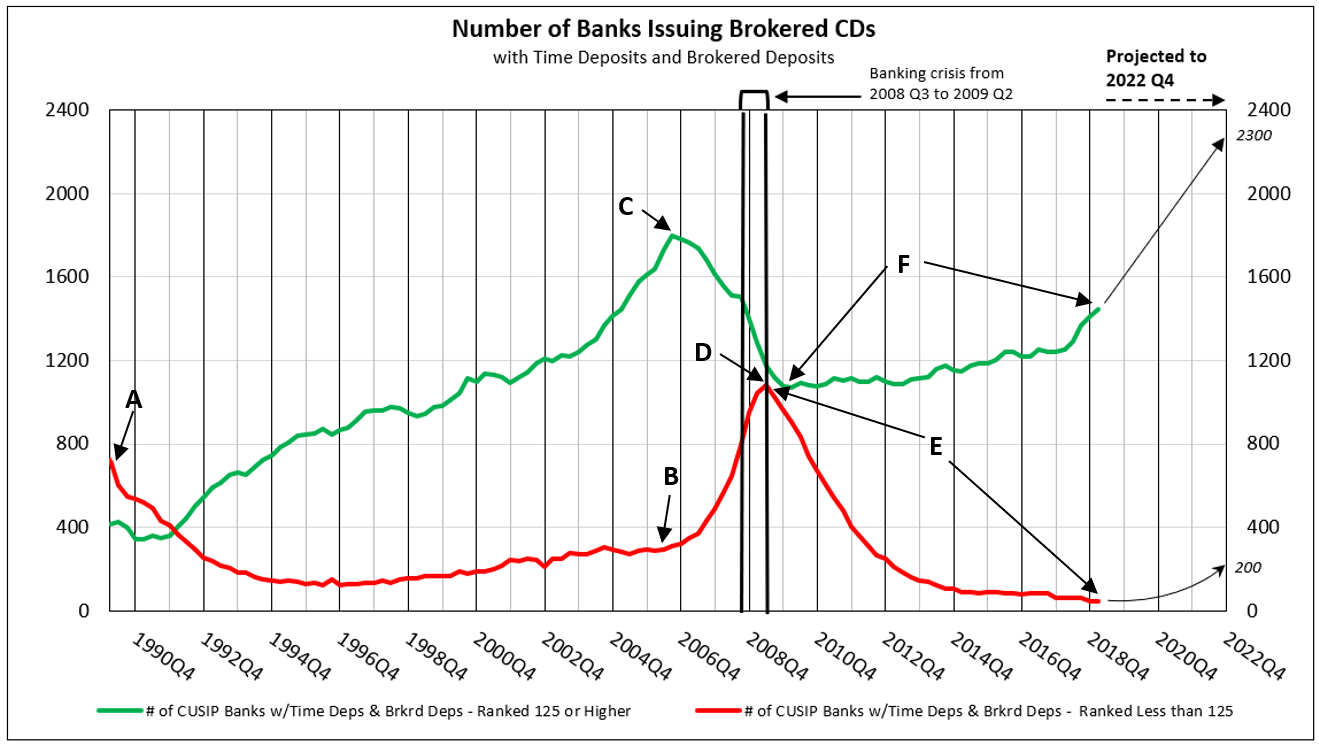

Chart I

In Chart I above, the red line plots the numbers of banks with an IDCFP rank less than 125. The number of these high-risk banks reached peak levels in the early 90’s (A), following the banking crisis in the late 80’s. The number of high-risk banks issuing brokered CDs then declined and stabilized at low levels until 2006.

IDCFP’s Ranks Forecast the Banking Crisis of 2008 - 2009

In early 2006, the number of banks with an IDCFP rank below 125 began to accelerate (B). At the end of that same year, banks with a rank of 125 or higher, peaked at 1,800 (C) and began a decline. Together, the change in the numbers of these banks forecast the crisis of 2008-2009. The peak and decline of the red line illustrate the end of the banking crisis, and the beginning of the resolution of high-risk banks.

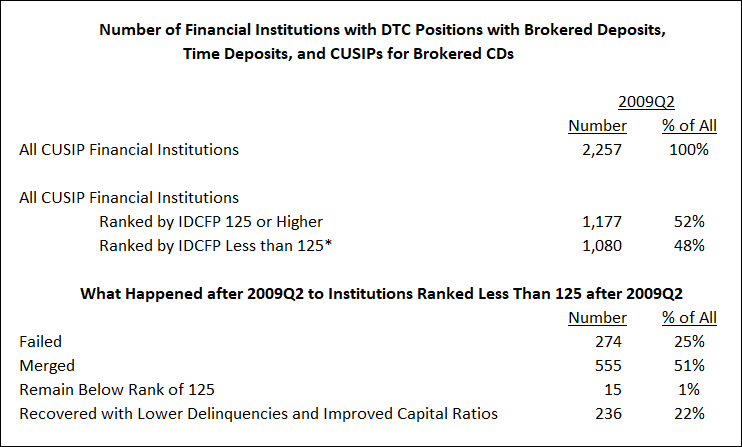

The second quarter of 2009 produced the largest number of institutions with a safety rank below 125, reaching peak level (D). The total number of banks with brokered deposits, time deposits and CUSIP numbers for outstanding CDs numbered 2,257. Out of this total, 1,177 (52%) banks were ranked 125 or higher, and 1,080 (48%) were ranked less than 125.

Out of the 1,080 high-risk banks, 274 (25%) failed, 555 (51%) merged, 15 (1%) currently remain below investment grade, and 236 (22%) recovered, attaining a rank of 125 or above due to reduced delinquencies or improved capital ratios as of the 1st quarter of 2019 (see Table I).

Table I

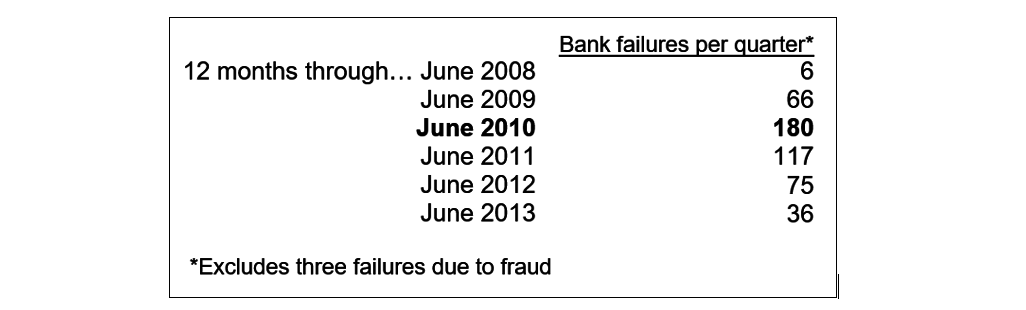

Table II below shows the number of bank failures continued to accelerate until June 2010, following the peak of institutions ranked less than 125 in 2009 by IDCFP.

Table II

Select Bank Mergers Improve Financials

From June 2009 to March 2019, a total of 555 institutions merged that we ranked below 125. Of these, 398 institutions merged into surviving institutions ranked 125 or higher. These low institution ranks were published prior to the merger and were a measure of high risk. As a result, the 398 merged institutions not only survived, but also benefited since our rank of those banks, with CDs in existence or to be issued, rose from below investment grade to above.

The Importance of IDCFP’s Ranks to Monitor Institutions Post-Banking Crisis

The demand for our financial institution ranks measuring the safety and soundness of banks continued strong from 2008 and post-crisis, as banks continued to fail and merge with higher rated surviving institutions.

- As of June 30, 2009, banks and savings institutions ranked less than 125 by IDCFP totaled 1080, or 48% of all ranked institutions (see Table I).

- Despite the peak in the number of high-risk banks in June 2009, failure of banks and savings institutions continued to accelerate into June 2010 and remained high through June 2013 (see Table II).

- When the resolution of the Banking Crisis of 2008-2009 occurred, the number of banks ranked less than 125 declined significantly from June 2009 to March 2019 (E, Chart I) and was primarily due to bank failures and mergers mentioned above.

- Only 236, or 22% of institutions ranked below 125, survived failure or were not involved in a merger.

- Of the 555 institution mergers from June 2009 to March 2019, 398 of these were ranked less than 125, or below investment grade, at the time of the merger, thereby improving their rank following it.

Crisis then Recovery

The total number of banks and savings institutions issuing brokered CDs ranked over 125 in the 2nd quarter of 2009 was 1,177 and has grown to 1,448 as of March 31st, 2019. Not only did the number of investment grade institutions grow by 271 in over 8 years, but, in addition, 829 institutions below investment grade in June 2009 (274 failures and 555 mergers) were replaced by new banks.

The increase in the number of institutions ranked below 125 clearly predicted the banking crisis of 2008, as early as 2006 when those numbers began to rise. The peak and subsequent decline in lower-ranked institutions also forecast the end of the banking crisis in 2009. Additionally, the increase in new banks issuing brokered CDs, the replacement of 829 institutions, plus the sharp decline in number of high-risk banks, all illustrated the recovery period from 2010 to early 2019 (F, Chart I). Our ranks of banks were critical, particularly for investors in brokered CDs, during this recovery period.

IDCFP’s Outlook for the Future

Why Our Ranks are Critical for Investors

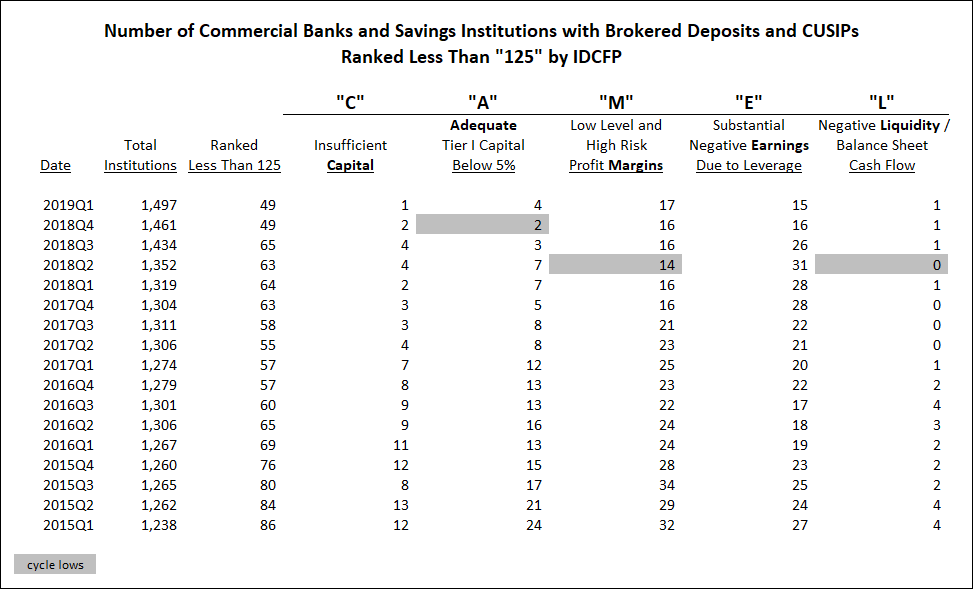

Like the period of increasing bank risk in 2005-2006, we have witnessed a new low number of commercial banks and savings institutions ranked below 125, with that number falling to, and remaining at, 49 in the 1st quarter of 2019. In addition, three components of IDCFP’s CAMEL analysis reached cycle lows during 2018Q2 and 2018Q4 (see Table III). IDCFP projects the 49 banks will increase to 200 institutions by year-end 2022, therefore any financial crisis in banks will most likely be delayed until 2022 or beyond.

Table III

If the number of high-risk banks increases, so does risk to CD portfolios. However, a strong economy, bank deregulation and favorable interest rates drive a healthy banking environment. With this continued strength of the economy and strong loan demand for select financial institutions, IDCFP forecasts the number of banks issuing brokered CDs and ranked 125 or higher to accelerate from 1,448 in 2019Q1 to 2,300 by year-end 2022, following the trend established in 2018 and early 2019 (see Chart I). As in the past, our ranks are critical for investors going forward to monitor the strength of financial institutions during periods of risk or growth.

For further information or to view our products and services please feel free to visit our website at www.idcfp.com or contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director