Using IDC’s Analysis in an Educational Platform

Many institutions rely on IDC Financial Publishing (IDCFP) CAMEL rankings to do business. This includes financial institutions that buy and sell brokered CDs, insurance companies, state and local governments, federal agencies, private companies, as well as individual banks, savings institutions and credit unions. In addition to business demands, IDCFP’s analysis have also been used for many years as an educational resource.

Dr. David Cole is a Professor Emeritus of Finance from Fisher College of Business at The Ohio State University. As in previous years, he will use IDCFP’s Net Operating Profit (After Tax) Return on Equity (NOPAT ROE) analysis as part of his instruction at the Pacific Coast Banking School (PCBS) in this summer 2019 session. Dr. Cole presents our unique calculations for return on earning assets (ROEA) and return on financial leverage (ROFL), both key components of our NOPAT ROE, a core element of IDCFP’s bank analysis.

During his two-week instruction for first year students, Dr. Cole’s lectures focus on bank profitability, bank economic value and enterprise risk. He discusses the traditional profit model of return on average assets and financial leverage and compares that to IDCFP’s approach. Through this comparison, he demonstrates how our definition for operating returns before funding costs on earning assets (ROEA) is a very useful measure of a bank’s management of operations. Also, how our return on financial leverage (ROFL) measures financial management and the degree to which a bank uses deposits, borrowings, and debt to fund the earning assets not funded by adjusted tangible equity.

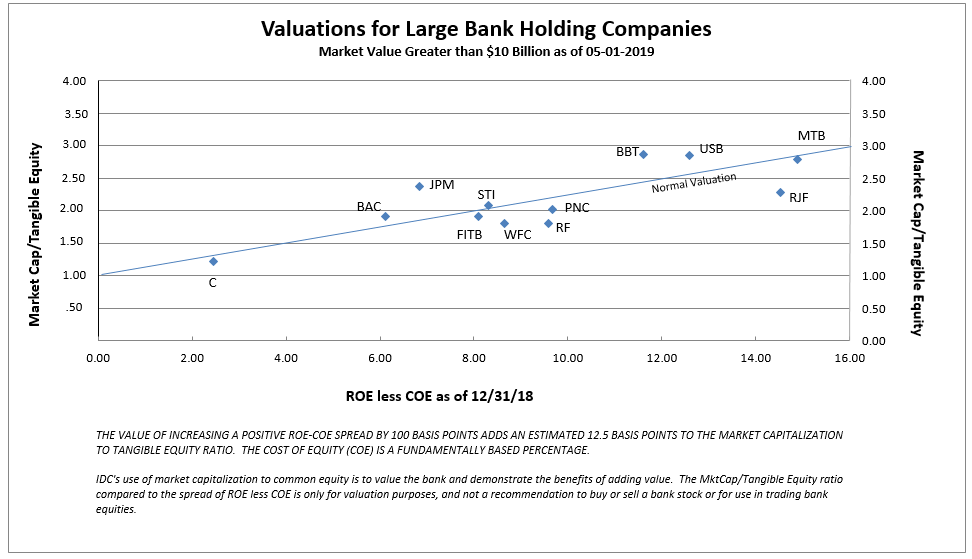

Dr. Cole will also highlight IDCFP’s focus on NOPAT ROE. We define ROE as net operating profit available to common stockholders divided by the average of common stockholder’s tangible equity capital plus the loan loss reserve. As of 2019, we measure ROE using tangible equity to capture the bank’s real cash returns and compare it COE, which identifies the risks in the bank’s profit structure. The importance of applying the proper ROE against a risk-adjusted COE is illustrated in the following chart plotting bank stock valuations. The wider the spread between ROE less COE, the higher the value of the bank compared to its tangible common stockholder’s equity capital (or price-to-book value).

Students will complete their study with an extension problem which involves analyzing and evaluating the profitability, value, and risk of their bank. To assist them in answering this extension problem, they will be provided samples of IDCFP’s ranks and analysis to use as a valuable source of financial information.

Similar to our customers, a student banker can access and view the important metrics of a bank, simply by visiting our online portal.

To view our products and services please visit our website at www.idcfp.com . For more information about our CAMEL ratings, or for a copy of this article, please contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA, President, jer@idcfp.com

Robin Rickmeier, Marketing Director