Margins as a Measurement of Management: The M in CAMEL

IDC Financial Publishing, Inc. (IDCFP) uses the acronym CAMEL and its component financial ratios to evaluate the safety and soundness of commercial banks and savings institutions. This article explains how IDCFP uses margins as a component of its CAMEL ranking system and why it is valuable and important to monitor.

The key Margins that Measure Management include Return on Equity (ROE) vs. Cost of Equity (COE), Operating Profit Margin (Inverse of Efficiency Ratio) and Standard Deviation of the Operating Profit Margin over 3 to 5 years. Components of the operating profit margin are also analyzed separately and rated. As an example, margins with a negative spread between ROE and COE, an operating profit as a percent of net interest and noninterest income (OPM) below 20% and a standard deviation in the operating profit margin of 8 or higher, together, indicate a bank or savings institution at risk. Many combinations of ROE less than COE and the level and standard deviation of the operating profit margin determine varying levels of risk to the bank or savings institution.

Commercial banks and savings institutions with ROE less than COE, narrow or negative operating margins and/or large standard deviations in the operating profit margin are ranked by IDCFP below the rank industry standard for safety and soundness of “125” (300 the Highest and 1 the Lowest).

ALERT

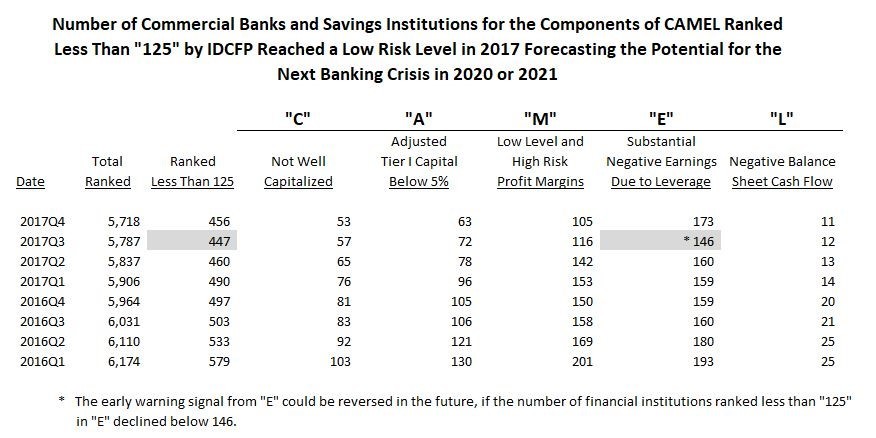

The “E” Component of CAMEL, as Well as, the Total of Banks Ranked Less Than “125”, Indicates Risk from our Early Warning System of a Future Financial Crisis in 2020 or 2021.

The low risk level in the number of banks and savings institutions of 146 ranked less than “125” in “E” in the 3rd quarter 2017, caused a low for all institutions ranked less than “125” of 447 in the 3rd quarter of 2017 (see Table I).

The risk in a bank or savings institution is a negative ROE, which destroys equity capital. The risk is amplified, however, to the institution’s safety and soundness, when ROFL is negative. The operating earnings ratio (ROEA) is low or negative and the cost of adjusted deposits and debt exceeds ROEA, causing a negative leverage spread, and then, times financial leverage, creates an even greater loss, as reflected in ROFL. Currently, a negative ROFL has been exhibited in smaller banks. As the Federal Reserve raises the fed funds rate by 1% to 1.5% in the next two years, the low levels of operating returns (if not corrected) accompanied with rising costs of funding, create continuous future losses in net income for these 173 firms and, potentially, more financial institutions. Given Reported and Continuing Future Losses, Recent Tax Reductions Fail to Assist These Institutions.

Table I

All 5 categories of rank, C-Capital, A-Adequacy of Capital, M-Margins as a Measurement of Management, E-Earnings from Operations and, separately, Earnings from Financial Leverage, and finally, L-Liquidity all together provide a timely indication of risk and potential failure. Additional components of CAMEL, however, are required to increase in the count of banks under “125” in other CAMEL components to confidently forecast the severity of the coming banking crisis.

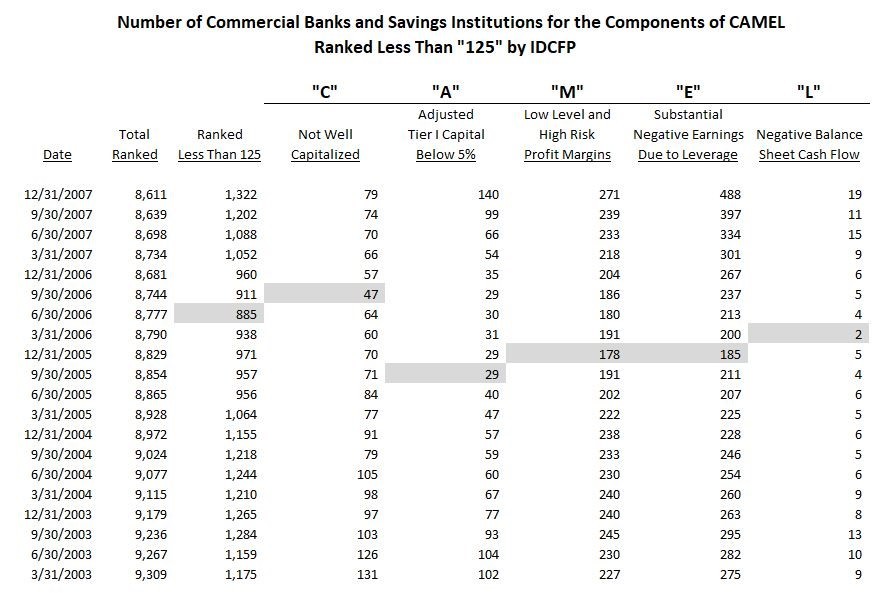

Early Warning Indicators in 2005 and 2006 (see Table II)

The low in the number of commercial banks and savings institutions ranked below the industry standard as investment grade “125” occurred in the 2nd quarter of 2006, two years before the banking crisis in 2008. Most important, however, is that all but 1 of the 5 components of CAMEL reached a low in their number of institutions from the 3rd quarter of 2005 through the 1st quarter of 2006 – prior to the low count for all institutions ranked less than “125” in the 2nd quarter of 2006.

As seen in Table II below, commercial banks and savings institutions not well capitalized (“C” in CAMEL) reached a low of 47 in the 3rd quarter of 2006. Financial institutions measuring adequacy of capital with adjusted Tier 1 capital below 5% (Tier 1 capital adjusted for bad and delinquent loans net of the loan loss reserve), the “A” in CAMEL, reached a low count of 29 in the 3rd quarter of 2005. Banks and savings institutions with a lack of profitability or low and unstable margins, the “M” in CAMEL, reached a low of 178 in the 4th quarter of 2005. The commercial banks and savings institutions with severe negative “Earnings due to Leverage” (the “E” in CAMEL) reached their low of 185 in the 4th quarter of 2005, two quarters before the total number of institutions ranked below “125” reached its low in the 2nd quarter of 2006. Finally, institutions with high loan delinquency and negative balance sheet cash flow – the “L” in CAMEL – reached their low of 2 in the 1st quarter of 2006.

Table II

Components of CAMEL Forecast Banking Crisis in 2005, up to Three Quarters Before the Total Ranked Below “125” in June of 2006

IDCFP has been helping CD brokers and investors, insurance companies, federal agencies, numerous state governments and a host of other institutions make better decisions using its unique and proprietary CAMEL rating methodology since 1985. For more information on CAMEL go to www.idcfp.com or call 1-800-525-5475.