Liquidity Risk - - The “L” in CAMEL

IDC Financial Publishing, Inc. (IDCFP) uses the acronym CAMEL and its component financial ratios to evaluate the safety and soundness of commercial banks and savings institutions. This article explains how IDCFP uses liquidity as a component of its CAMEL ranking system and why it is valuable and important to monitor.

Liquidity risk to the safety and soundness of a commercial bank or savings institution is defined by loans, delinquent, nonaccrual or repossessed assets greater than 4% of loans together with negative balance sheet cash flow as a percent of equity capital.

Balance sheet cash flow equals operating cash flow less financial cash flow. Operating cash flow equals the annual change in retained earnings less the annual changes in growth producing assets. The purpose of measuring operating cash flow is to determine the ability to internally finance the growth in producing assets.

Financial cash flow isolates the annual change in sources and uses of funds, other than the change in retained earnings, growth in producing assets and cash and equivalents. Financial cash flow equals the annual change in liabilities (excluding retained earnings) less the annual change in loans and investments and other non-cash and equivalent current assets.

Balance sheet cash flow subtracts the financial cash flow from operating cash flow. Major negative balance sheet cash flow occurs if annual changes in retained earnings are negative and/or the annual change in all other liabilities substantially exceeds the annual changes in loans and investments. An institution with poor loan quality or risky investments experiences asset write-offs or write-downs, and at the same time, deposits are increased or new borrowings incurred to finance the asset base, then, a major negative balance sheet cash flow as a percent of equity occurs.

Commercial Banks and Savings Institutions with Major Negative Balance Sheet Cash Flow as a Percent of Equity Capital and Loan Delinquency in Excess of 4% of Loans are Ranked by IDCFP Below the Rank Industry Standard for Safety and Soundness of “125” (300 the Highest and 1 the Lowest).

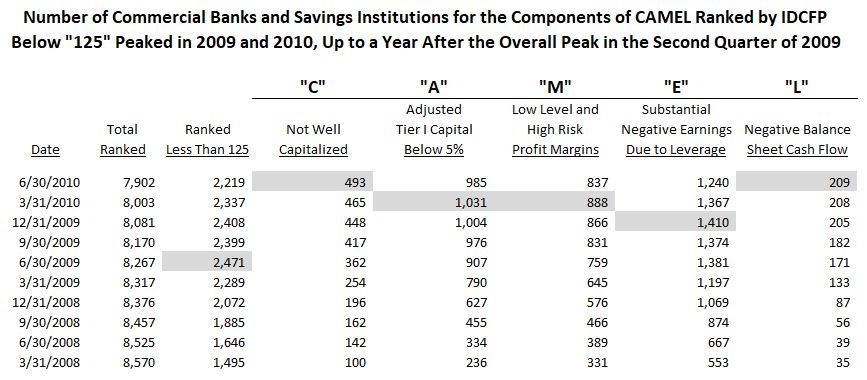

As seen in the table below, institutions ranked less than the industry standard for investment grade of “125”, peaked in the 2nd quarter of 2009 at 2,471 or 30% of the 8,267 total number of domestic commercial banks and savings institutions. The number of commercial banks and savings institutions at risk due to excessive loan delinquency and negative balance sheet cash flow peaked at 209 four quarters later in June of 2010.

Other rating agencies that primarily focus on capital ratios and only loan delinquency fail to capture the risk associated with negative balance sheet cash flow and its impact on the risk of bank failure. As witnessed in IDCFP’s CAMEL analysis, categories of CAMEL with their rank calculations lag behind the timely and unique combination of these components in the IDCFP rank of financial ratios.

This illustrates that all 5 categories of rank, C-Capital, A-Adequacy of Capital, M-Margins as a Measurement of Management, E-Earnings from Operations and, separately, Earnings from Financial Leverage, and finally, L-Liquidity all together provide a timely indication of risk and potential failure.

Most important, the number of banks and savings institutions with IDCFP ranks below “125” began sharply increasing after the 2nd quarter of 2006, well before the financial crisis of 2008 and 2009.

IDCFP has been helping CD brokers and investors, insurance companies, federal agencies, numerous state governments and a host of other institutions make better decisions using its unique and proprietary CAMEL rating methodology since 1985. For more information on CAMEL go to www.idcfp.com or call 1-800-525-5475.