IDC's Remarkable Record - Updated for 3rd Quarter 2017 Ranks

“IDC has a remarkable track record of identifying deteriorating or improving performance months, and sometimes years, before it becomes apparent to other ranking companies,” as stated on the Washington State Department of Financial Institutions website and as displayed on IDC Financial Publishing, Inc.’s website. The following review of IDCFP rankings and bank failures supports the above conclusion.

IDC Financial Publishing, Inc. (IDCFP) ranks, measuring the safety and soundness of banks, savings banks, savings and loans and credit unions, range from “300” (the best) to “1” (the lowest). The brokered CD marketplace established that, of financial institutions ranked by IDCFP, those institutions ranked less than “125” were not investment grade or suitable for investment in certificates of deposit.

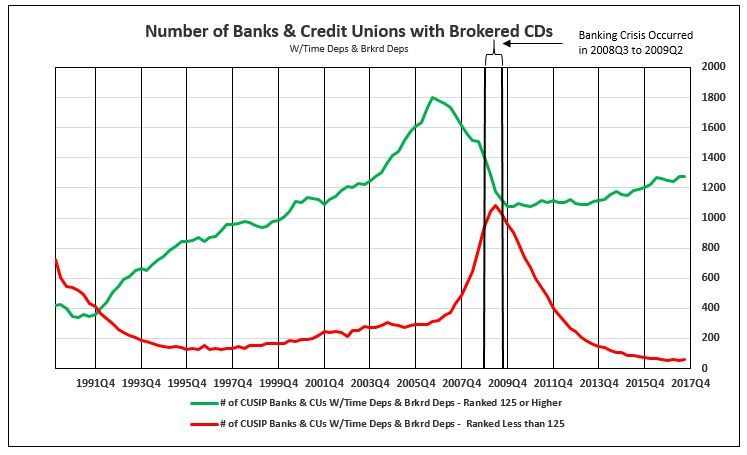

To better understand the demand for IDCFP’s rank of financial ratios for banks, thrifts and credit unions, Chart I plots the number of financial institutions issuing brokered CDs from 1999 to September 30, 2017 ranked “125” or higher – investment grade CD issuers. In the initial years, the number of CD issues reflected the banking crisis of the late 1980’s, as the number of institutions ranked less than “125” declined to their lows in 1995.

From 1992 to 2004, investment grade CD issuing financial institutions grew from 442 to 1,413, and, then, accelerated in the housing boom from 1,413 in 2004 to a peak of 1,801 in the third quarter of 2006.

Decline in IDC Ranks Forecasts Banking Crisis

Beginning in the 3rd quarter of 2006, after years of continuous increases in the number of issuers of investment grade (rank “125” or higher) CDs, these numbers of financial institutions peaked and declined, forecasting, with a two-year lead time, the Banking Crisis that began in the 3rd quarter of 2008 (see Chart I).

Chart I

The number of investment grade CD issuers declined from 1,801 in the 3rd quarter of 2006 to 1,177 in the 2nd quarter of 2009.

In the period leading up to the financial crisis in the 3rd quarter of 2008, financial institutions issuing brokered CDs ranked less than investment grade (less than “125”) grew from 300 in 2006 to 1,080 in the 2nd quarter of 2009.

The following analysis tracks the 1,080 institutions ranked less than “125” in the 2nd quarter of 2009, who and when failed, merged, remain ranked under “125”, and those that succeeded with a rank rising to “125” or higher.

Second Quarter of 2009

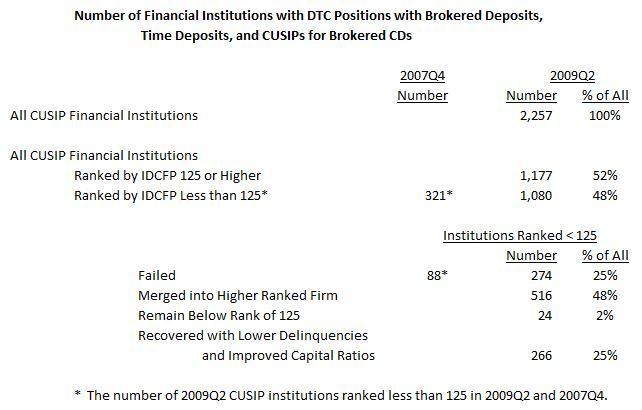

The second quarter of 2009 produced the largest number of financial institutions with an IDCFP rank below “125”. In 2009Q2, all institutions with brokered deposits, time deposits and S&P assigned CUSIP numbers for outstanding CDs numbered 2,257. Out of this total, 1,177 (52%) financial institutions were ranked “125” or higher, and 1,080 (48%) were ranked by IDCFP less than “125” (see Table I). The 1,080 financial institutions ranked less than “125” in 2009Q2 reached their peak level (see Chart I).

Out of the 1,080 financial institutions ranked below “125” (below investment grade) in 2009Q2, some 274 (25%) failed after 2009Q2, 516 (48%) merged into a higher ranked firm, 24 (2%) remained below investment grade (rank less than “125”), and 266 (25%) recovered in ranking to “125” or above due to reduced delinquencies or improved capital ratios as of the 3rd quarter of 2017.

The uniqueness and value of the IDCFP rank is explained not only by predicting failure, but also by a merger of a financial institution ranked less than “125” into a new firm with a rank equal to or higher than “125”, therefore, resetting their existing below investment grade CDs, issued by the old firm, into the new institution with an investment grade rank. The same impact occurs as an existing institution raises capital or reduces delinquencies, increasing their rank to “125” or higher providing the opportunity to then purchase their investment grade CDs in the secondary market.

Table I

The Value of IDC Ranks

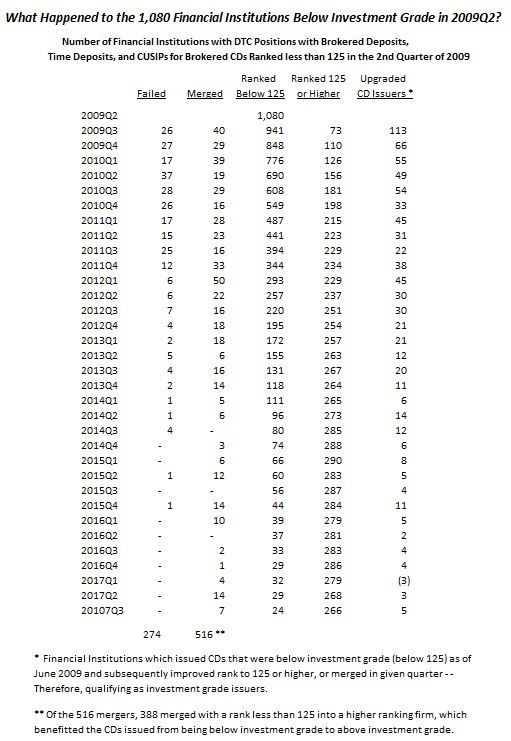

The time required to resolve financial institutions ranked below “125” in the next 8 years demonstrated the value of IDC ranks.

While the peak in financial institutions ranked below “125” of 1,080 occurred in the 2nd quarter of 2009 as identified by IDCFP, it took months, quarters and even years to resolve these failures, mergers, or recoveries (see Table II).

The changing levels of IDC’s safety and soundness ranks of financial institutions requires careful monitoring of all ranks each quarter, in order to capitalize on the institutions ranked below “125” to ranks “125” or higher and qualify these CDs as investment grade and, therefore, qualifying for purchase.

The value added of IDCFP ranks can be seen in Table II as to the early identification of problem financial institutions and the number of continuing financial institutions ranked under “125”.

Table II