ROE Compared to COE Still the Best Indicator of Value

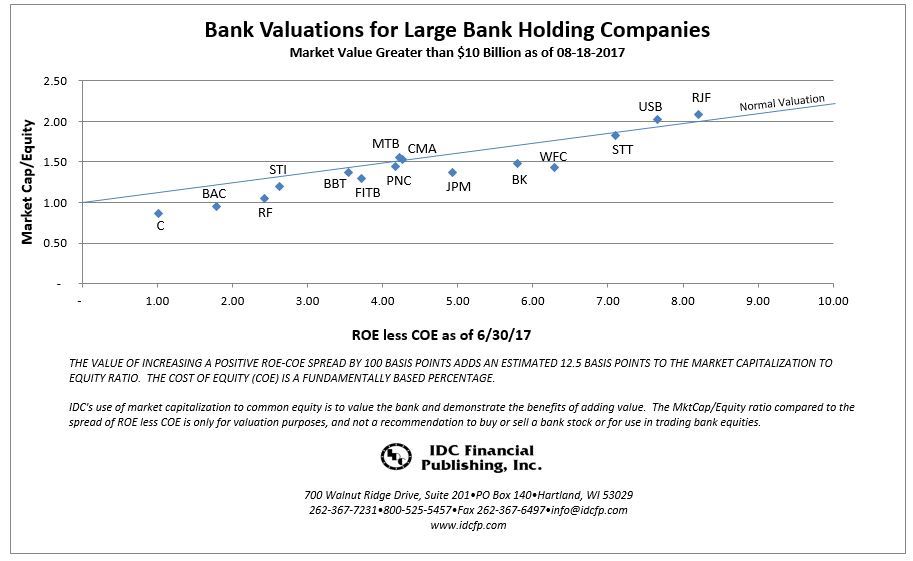

Investors and analysts measure the performance of bank holding companies by comparing return on equity (ROE) against the cost of equity capital (COE). If the ROE is higher than the COE, management is creating value. ROE less than COE, management destroys value. Value is measured by stock price to book value, i.e. equity market capitalization to book value of common stock (See chart below “Bank Valuations for Large Bank Holding Companies”).

But some critics say the method is flawed, one side (ROE) or the other (COE). Banks, as an example, have insisted returns should be measured on tangible equity, excluding goodwill and other intangible assets from the calculation, generating a higher ROE, but lower tangible book value. IDC Financial Publishing, Inc. (IDCFP) finds a nominal four quarter ROE, as reported, the most useful and accurate.

A second side of the equation is cost of equity. Some analysts use a long standing rule of thumb of 10% cost of equity. IDCFP however, uses the long-term U.S. Treasury yield plus one-half of that yield, adjusted for bank specific risk. In today’s market, a long bond U.S. Treasury yield on 6/30/2017 was 2.8%, and the average cost of equity capital for the large bank holding companies was 4.7%, ranging from 4.00% for Raymond James Financial (RJF) to 5.84% for Bank of America Corp (BAC).

The tight fit of the Market Capitalization/Book Common Equity compared to IDCFP’s ROE less COE for large banks in the enclosed chart demonstrates the usefulness of a cost of equity capital tied to the long term U.S. Treasury yield to determine the price to book value.

The value of increasing a positive spread (ROE less COE) by 100 basis points adds an estimated 12.5 basis points to the market capitalization to equity ratio. The low valuations of BAC and C, with narrow ROE-COE spreads, confirm the valuation line, as does RJF and USB with high valuations to book value. Bank holding companies with special risks, not measured by ROE and COE, tend to sell below the valuation line, such as BK and WFC.

Creating Shareholder Value in Mid-cap Banks

The Benefits of Living on the Positive Valuation Slope

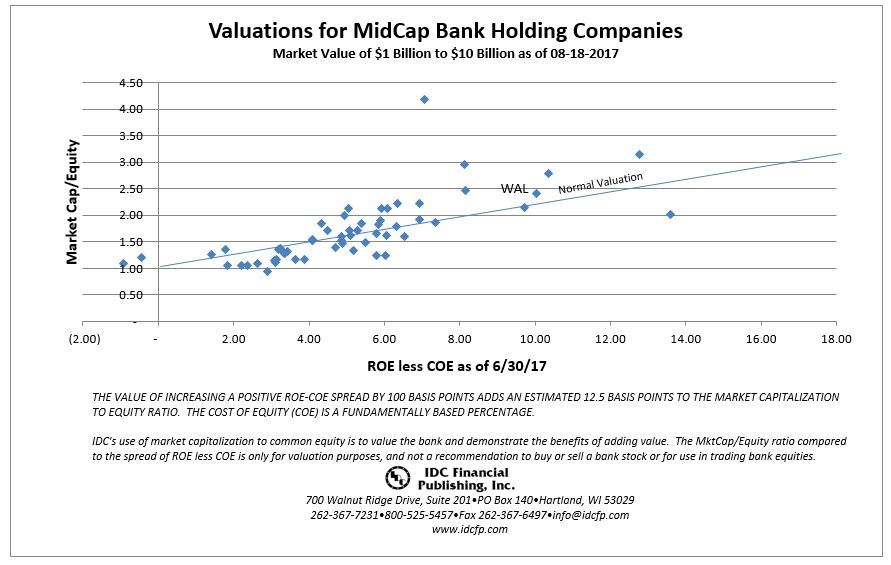

The mission of a bank is to operate a safe and sound financial institution, while creating shareholder value. The value of a bank, defined by the ratio of market value to common equity, most often is directly related to the return on equity (ROE) less the cost of equity capital (COE). The enclosed chart illustrates the benefits of living on the slope, or realizing a higher market value to common equity as the spread between ROE and COE increases.

The Market Capitalization/Book Common Equity compared to IDC’s ROE less COE for mid-cap bank holding companies (market capitalization from $1 to $10 billion) in the enclosed chart demonstrates the usefulness of a cost of equity capital tied to the long-term U.S. Treasury yield to determine the price to book value. IDC defines ROE as net operating profit after tax (NOPAT ROE) for the past four quarters ending June 30, 2017, and the level of long term bond yields as of June 30, 2017. Size of the bank and standard deviation of the operating margin (inverse to the efficiency ratio) define specific risk in calculating COE.

The benefits of a high market capitalization to common equity are twofold. As an example, one benefit is Western Alliance Bancorp (WAL) sells at a market value equal to 2.4 times equity due to a spread of ROE less COE of 10.0%. The second benefit is a high ROE generates a high reinvestment rate or growth in common equity, thereby increasing market value at the reinvestment rate.

Western Alliance Bancorp demonstrates a simple business model stressing loans and deposits with a limited number of branches. Their customers tend to be a diverse cross section of all business and individuals. The bank, with $19 billion in assets, has a very clean balance sheet and very low non-interest expense when compared with its peers. Although heavily weighted in commercial real estate loans, Western Alliance Bancorp has been able to maintain low levels of non-performing assets. They also prefer to avoid high-risk derivatives. All of these characteristics with a high ROE provided earnings growth, which led to increasing share values. Western Alliance Bancorp share value, as of 08/18/2017, increased 1,224 percent since its low point in December of 2009 and outperformed its peers.