Community Bank Stocks Driven by Spread Between ROE and COE

In a previous article, the major bull market in bank stocks of 300%, from the first quarter of 1995 to year-end 2006, was driven by the widening spread between return on equity (ROE*) and the cost of equity (COE*), as defined by IDC Financial Publishing, Inc. (IDCFP). In the article, IDCFP demonstrated the major driver in the bank stock performance in the bull market was the decline in the cost of equity (COE), as the ROE fluctuated around 14.5%, reaching a peak of 16.4% in March, 2000 and declining to 13.5% at the end of 2006 (See article below).

The bear market, with a sharp decline in ROE for banks, began from the end of 2006 to March, 2009. The large bank stock index (BKX) declined 76.3% from 117.78 on December 31, 2006 to 27.90 on March 31, 2009.

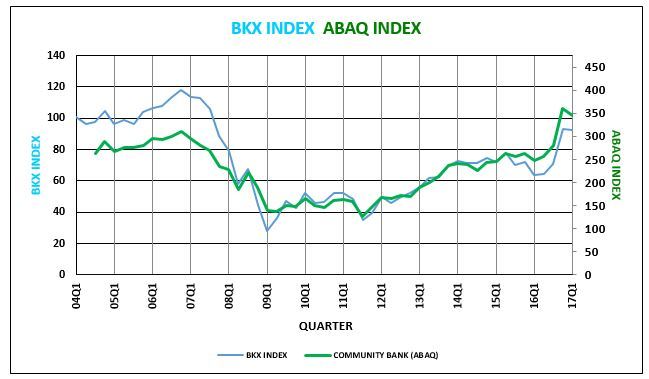

How Did Community Banks Perform Relative to Large Bank Stocks (ABAQ vs BKX)?

The community bank stock index (ABAQ) began in 2004, reaching a peak of 311.29 on December 31, 2006 and declining to 138.33 on March 31, 2009 for a 55.6% decline, less than the 76.3% drop in the large bank stock index (BKX). -- See Chart I

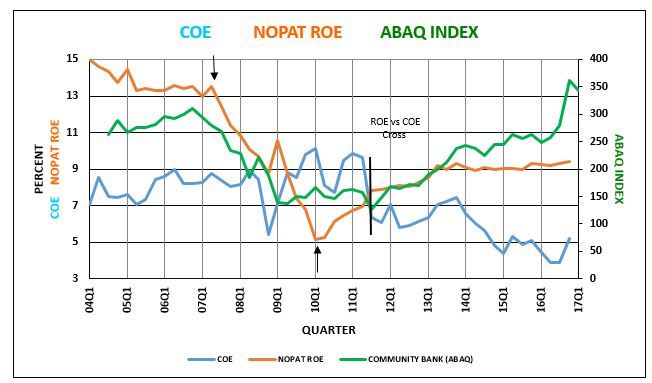

Bank stocks both large and community fell into a losing pattern from June of 2009 to the end of 2011, as the COE rose and remained above ROE (See Chart II).

The next bull market for all bank stocks began in late 2011 as the ROE again rose above COE. ROE increased from 7.9% at year-end 2011 to an average of 9% for 2013 to-date for all banks. More importantly, COE peaked at 10% in March 2011 and declined to 4.1% as of June 2015, falling below ROE in the 4###sup/sup### quarter of 2011 (See charts II and III).

From a low in September, 2011 to June, 2015, the large banks BKX rose 120.5%, while the community banks increased 108% (ABAQ for all community banks rose 108.2% and ABQI for actively traded community bank stocks increased 108.7%).

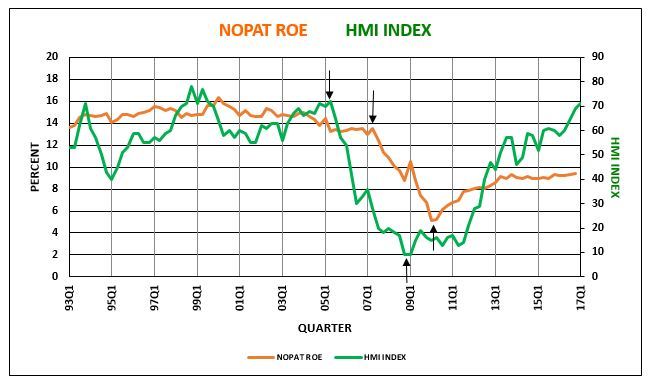

Forecasting ROE for bank stocks requires an economic variable that predicts profitability. Since bank stock profits, in large part, depend on real estate lending, the Housing Market Indicator (HMI) is a leading indicator forecasting changes in ROE. The HMI is a survey of realtors’ expectations of home sales, traffic and other housing indicators. The HMI peaked in mid-2005, leading the peak and decline in bank ROE in June 2007. The low in HMI in March, 2009 predicted the low in ROE as of December, 2009. Currently, HMI reached new cycle highs, predicting rising ROEs for bank stocks (See chart IV).

Success for bank stocks is a rise in ROE faster than the increase in COE in a strong economy. COE, which is primarily a function of 30-year U.S. Treasury yields, fell to a low of 3.9% in a world of monetary stimulus and negative interest rates in 2016. More recently, long government yields have begun to increase and, then, paused. Long T-bond yields are expected to increase later in 2017. A 3% long U.S. Treasury yield, up from 2.3% in September 2016, would drive a 5% cost of equity (COE) for bank stocks, while a 3.5% yield on 30-year T-Bonds equates to a 5.9% COE.

The opportunity for bank stocks to appreciate in the future is for ROE to rise above current levels of 9.3% to 11% or higher, while COE remains near 5%. A spread between ROE and COE of 6% or more is necessary to foster a new bull market in bank stocks. The recent post-election recovery in bank stocks reflects an improved ROE due to anticipated tax reductions and better regulation.

Chart I

Chart II

ROE and COE used in chart II above are the asset weighted average of all U.S. banks for each quarter.

Chart III

ROE and COE used in chart III above are the asset weighted average of all U.S. banks for each quarter.

Chart IV

ROE used in chart IV above is the asset weighted average of all U.S. banks for each quarter.

* ROE as defined by IDCFP is net operating profit after tax (NOPAT ROE). In order to balance bank balance sheets and correct for over or under statement of the reserve for loan losses, the increase in the loan loss reserve adjusts net income reflecting net charge-offs vs. the loan loss provision. ROE can also then be defined as the Return on Earning Assets after-tax (before funding costs) plus the Return on Financial Leverage (after-tax cost of funding times leverage).

** COE as calculated by IDCFP uses a combination of general risk and specific risks. General risk is demonstrated by the 30-year T-Bond yield, while the risk premium for financial equities adjusts another 50% of the 30-year bond yield for specific risks. Specific risks for an individual financial institution include asset size, pretax coverage of net loan charge-offs, loan delinquency risk to capital, and variations in operating profit margins.