Bank Stocks Recover to Normal Valuation

Banks suffered under the Fed policy of ultra-low rates and anemic economic growth in recent years. Return on equity for banks averaged 9.4% over the past five years, compared to the five years ending 2006 of 14.6%. The net interest margin of 3.13% over the recent five-year period compares to 3.72% for the five years ending 2006. Between 1996 and 2006, U.S. banks had an average return on assets of 1.23%, compared to 0.94% since 2010.

If

banks had earned the pre-crisis return, cumulative earnings from 2010 (when the

Fed launched its bond buying program) through 2015 (when the Fed raised its

interest rate target) would have been around $1.07 trillion. Actual earnings were around 27%, or $250

billion less, according to the Wall Street Journal. The acceleration to 15% growth in bank

lending, rising interest rates and a stronger economy project a recovery in

bank earnings in 2017-18.

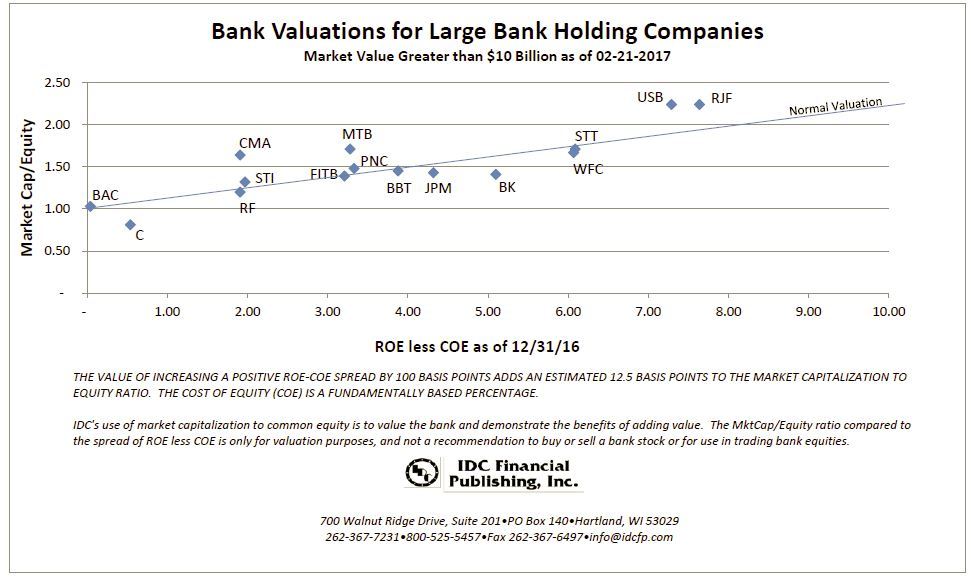

An

expected strong recovery in return on equity (ROE) coupled with a rise in cost

of equity (COE) drives returns to normal valuations. An ROE of 13% in future years offset by a COE

of 6% provides an ROE less COE spread of 7% and has increased the price to book

value ratio to 1.7 times -- the normal valuation of the pre-crisis years.

Current valuations in Chart I on February 21, 2017 are compared to the similar valuation line used for bank valuations on February 23, 2015 in Chart II.

Chart I

Price/Book Compared to ROE less COE for Large Banks 2-21-2017

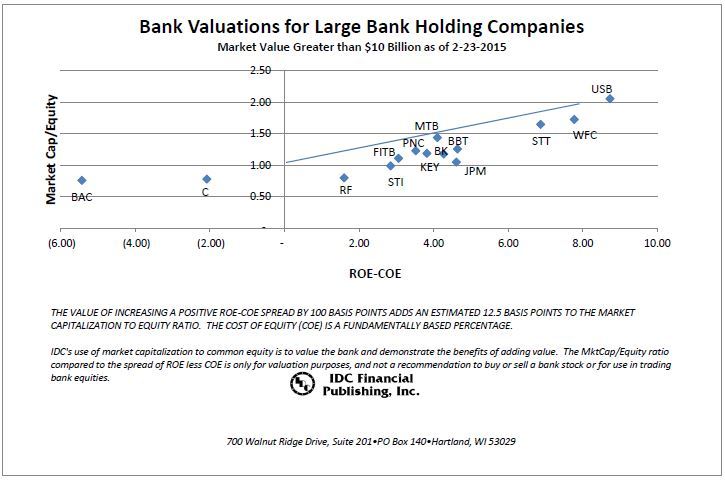

Chart II

Price/Book Compared to ROE less COE for Large Banks 2-23-2015