The Boom of Brokered Deposits and Link to Higher Wages

IDC Financial Publishing, Inc.’s (IDCFP) research indicates loan to deposit ratios above 84% generate an acceleration in brokered deposits. IDCFP believes that as community bank mortgage lending accelerates, those banks not issuing brokered CDs could benefit from the advantages of using this form of funding.

IDCFP took a look at banks over $100 million in assets and with a loan to deposit ratio greater than 84% that are not using the brokered CD market to fund their lending needs. There are currently 1,242 commercial and savings banks with the median bank having the following data:

Loans 207,785,000 Annual Growth 7.7%

Deposits 223,962,000 Annual Growth 3.4%

Time Dep 73,178,000 Annual Growth -3.2%

Loans/Deposits 93.6%

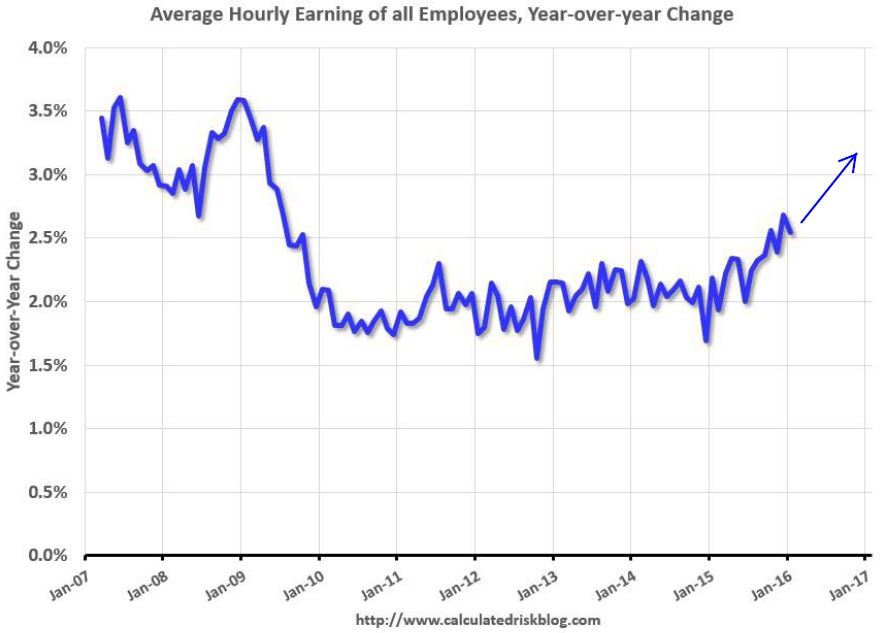

Wage Growth Accelerates Demand for Mortgages

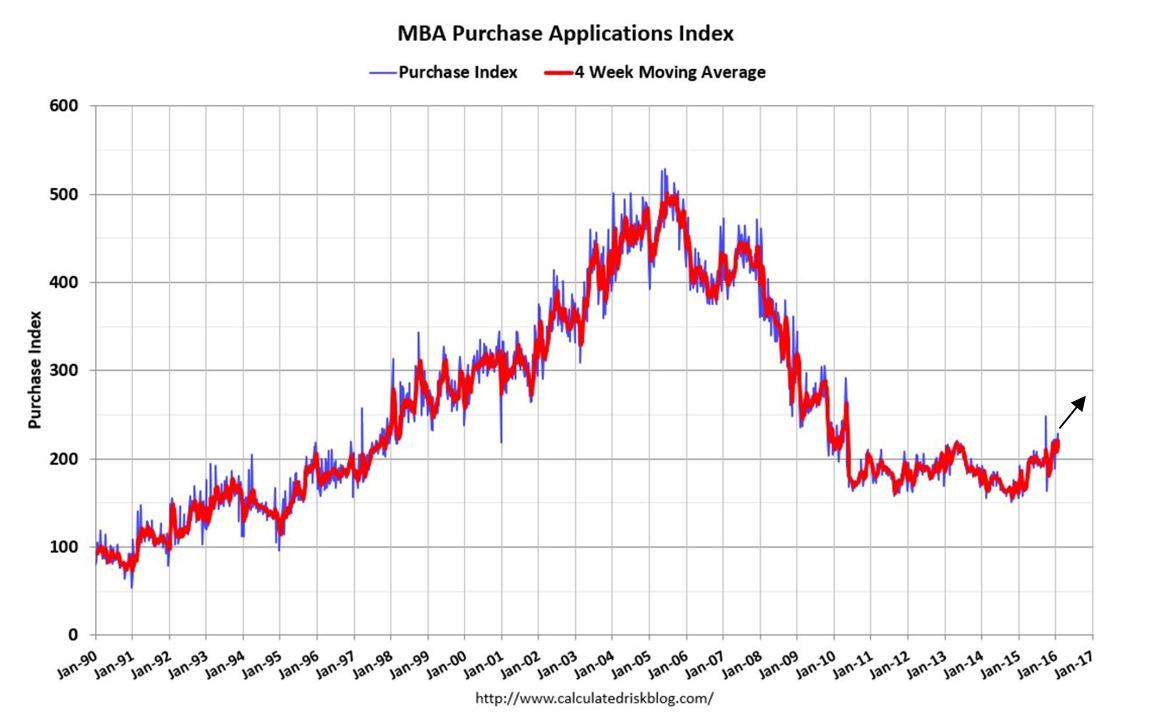

The acceleration in average wage growth from 2 percent to 2.5 percent is creating an acceleration in MBA purchase mortgage applications (see following 2 charts). A further acceleration to 3 or 3.5 percent in wage growth is expected to increase these applications to an index of 270, creating very strong community bank loan growth.

Accelerating Demand for Mortgages Creates Loan Demand

The Mortgage Bankers Association (MBA) reported on February 8, 2016 that the week’s results for the MBA Purchase Applications Index were 25% higher than the same week one year ago after a flat pattern of no growth over many years. The index of MBA Purchase Applications should accelerate in 2016 toward a level of 270 (see chart below).

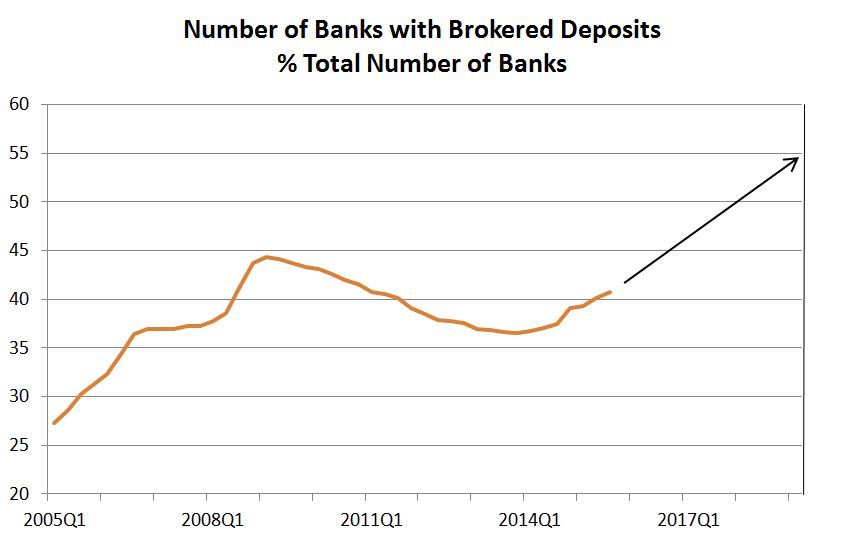

Rising Loan Demand Creates Increase in Brokered Deposits

With negative growth in time deposits and high loan to core deposit ratios for these 1242 banks, commercial and savings banks using brokered deposits as a percent of total banks are expected to accelerate to 55% by 2019, the coming boom in brokered deposits (see chart below).

IDCFP’s quarterly deposit database contains data on loans, assets, and total deposits, as well as types of deposits such as, savings, MMDA, demand, time, and brokered deposits along with their respective maturities. The data is sortable and, when used in conjunction with IDCFP’s ratings and CD CUSIP database, gives the best marketing list for promoting brokered deposits and brokered CDs.