Brokered CDs to Accelerate 82% by Year-End 2019

The Growth of Brokered CDs

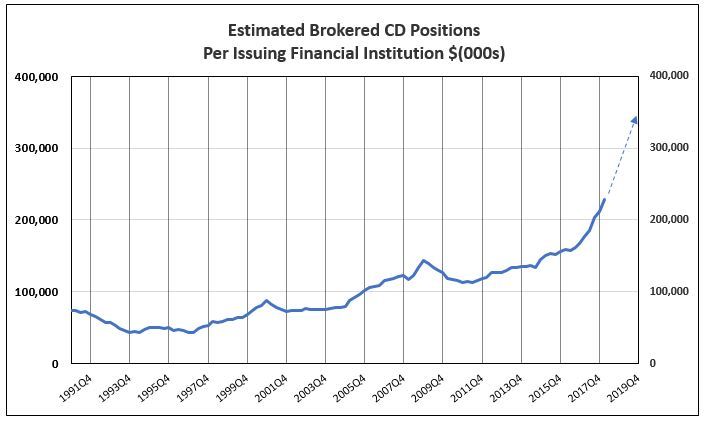

The total value of brokered CDs issued by a financial institution grew exponentially from an average of $44 million in 1997 to $228 million in the 1st quarter of 2018. This growth was due to an increase in insurance premiums, bank mergers, and strong growth in loans for those core banks issuing time deposits.

Each quarter, IDCFP uses the estimate of all brokered CDs outstanding, and divides it by the total number of financial institutions issuing these CDs to determine the average value of brokered CDs per financial institution. In the 4th quarter of 2008, the average value of brokered CDs outstanding peaked at $143 million, and then fell to under $116 million in 2010 following the banking crisis. Since then, the value per institution has risen, reaching a record average of $228.1 million in the 1st quarter of 2018.

The growth in the quarterly value of brokered CDs per issuing bank accelerated from $2.6 million per quarter in 2016, to $16.4 million in the 1st quarter of 2018. This quarterly value is expected to grow to $18 million in the 2nd quarter, creating an estimated average of $246 million per financial institution by June 30, 2018 (see chart below).

Brokered CDs Forecast on the Rise

The number of banks, thrifts and credit unions with outstanding brokered CDs was 1,348 at the end of the 1st quarter of 2018. As tax cuts, deregulation, infrastructure spending, and other government initiatives drive increased spending, GDP growth is expected to expand 3% or more a year. This, in turn, will create bank lending and cause an increased number of financial institutions to issue more CDs. Outstanding brokered CDs currently account for 23.8% of time deposits, up from 15.1% in the 4th quarter of 2008. This proportion of outstanding brokered CDs to time deposits has grown consistently each quarter from 2008 to 2018, and is projected to reach 30% by year-end 2019.

IDCFP estimates the average of brokered CDs per financial institution will rise to $350 million by 2019 (see chart below), and the number of financial institutions with brokered CDs could expand from 1,348 to 1,600. Based on this forecast, total estimated brokered CD balances would rise to $560 billion in 2019, an 82% increase in the reported balance of $307.5 billion in the 1st quarter of 2018.

.

For further information or to view our products and services please feel free to visit our website at www.idcfp.com or contact us at 800-525-5457 or info@idcfp.com.

John E Rickmeier, CFA

President

jer@idcfp.com

Robin Rickmeier

Marketing Director

IDC Financial Publishing, Inc.

700 Walnut Ridge Drive, Suite 201

PO Box 140

Hartland, WI 53029

P 800-525-5457

P 262-367-7231

F 262-367-6497