ROE Compared to COE Still the Best Indicator of Value

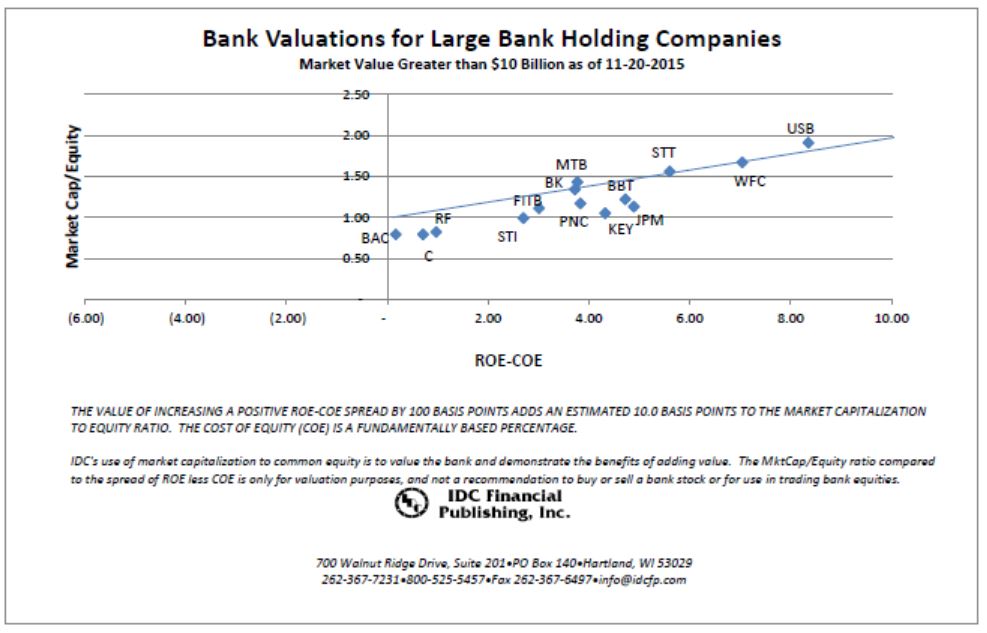

Investors and analysts measure the performance of bank holding companies by comparing return on equity (ROE) against the cost of equity capital (COE). If the ROE is higher than the COE, management is creating value. ROE less than COE, management destroys value. Value is measured by stock price to book value, i.e. equity market capitalization to book value of common stock (See attached chart “Bank Valuations for Large Bank Holding Companies”).

But some critics say the method is flawed, one side (ROE) or the other (COE). Banks, as an example, have insisted returns should be measured on tangible equity, excluding goodwill and other intangible assets from the calculation, generating a higher ROE, but lower tangible book value.

A second side of the equation is cost of capital. Some analysts use a long standing rule of thumb of 10% cost of capital. IDC Financial Publishing, Inc., however, uses the long term U.S. treasury yield plus one-half of that yield, adjusted for bank specific risk. In today’s market, a long bond U.S. Treasury yield on 9/30/2015 was 2.9%, and the average cost of equity capital for the large bank holding companies was 4.8%, ranging from 4.2% for Keycorp (KEY) to 6.1% for Bank of America Corp (BAC).

The tight fit of the Market Capitalization/Book Common Equity compared to IDC’s ROE less COE for large banks in the enclosed chart demonstrates the usefulness of a cost of equity capital tied to the long term U.S. Treasury yield to determine the price to book value.

The value of increasing a positive ROE – COE spread by 100 basis points adds an estimated 10 basis points to the market capitalization to equity ratio.

The low valuations of STI, KEY and JPM illustrate specific risk for each bank, not explained by interest rates or normal risk evaluation.

For further information please feel free to visit our website at www.idcfp.com or contact us at 800-525-5457 or info@idcfp.com.