About IDC

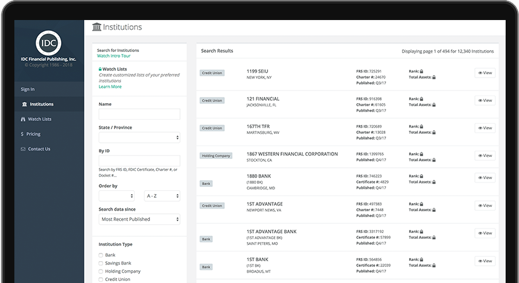

IDC Financial Publishing, Inc. (IDCFP) uses its unique CAMEL rankings of financial ratios to determine the safety ratings of banks, bank holding companies, and credit unions.

IDC's methodology for ranking financial institutions for safety is an open platform, allowing banks, holding companies, credit unions, and any client to understand financial ratios and rank for a specific institution.